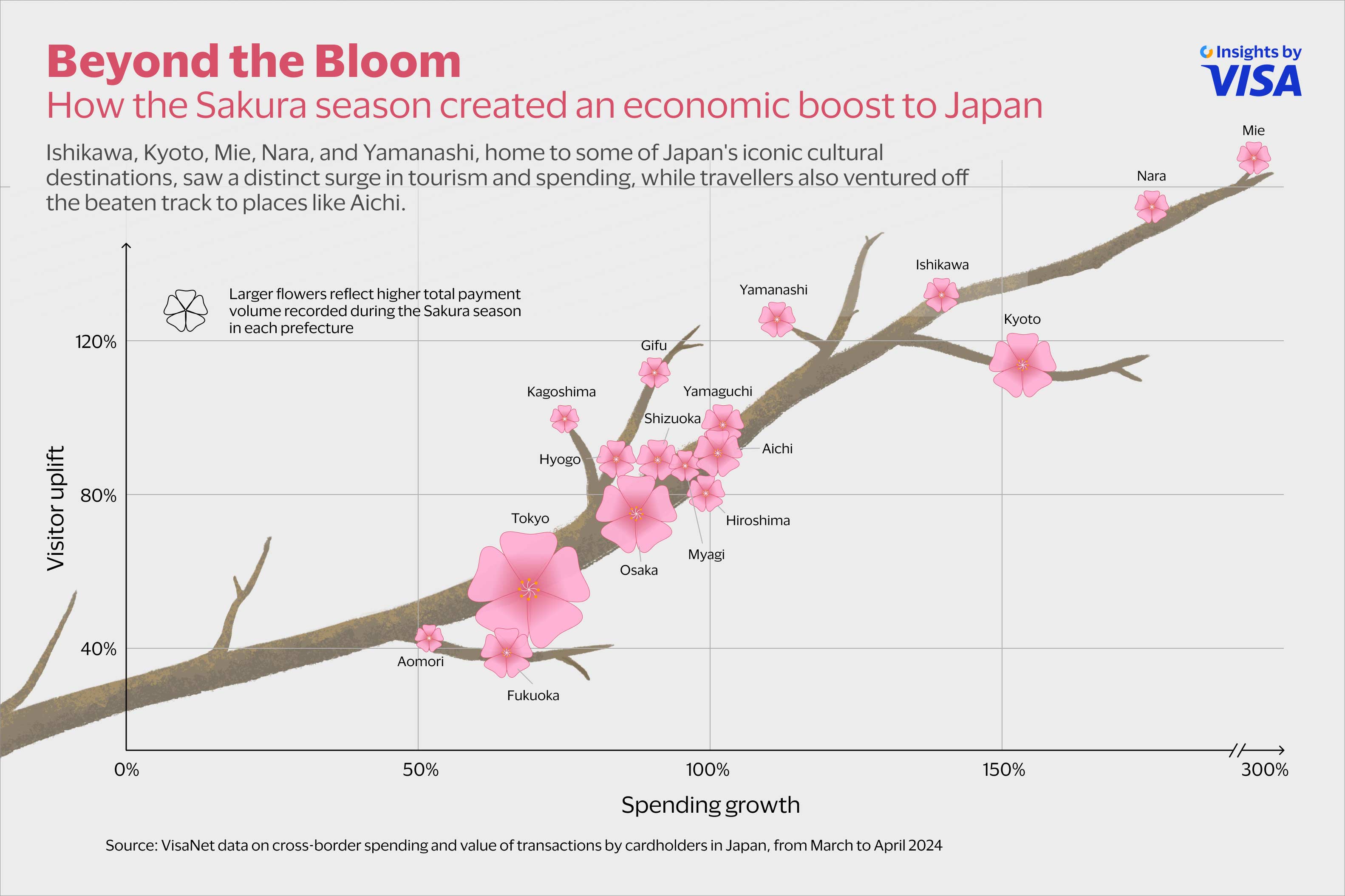

While metropolitan Tokyo and Osaka welcomed more travellers and travel spending, clocking about 60 to 70 percent growth in inbound traveller visits4, cultural hotspots and less-hailed destinations enjoyed the most significant uplifts as more travellers went off the beaten path to experience and immerse in Japanese culture.

Mie, located in Honshu within the Kansai region, received almost 300% more travellers and travel spending5, as many may have eyed a trip to the Ise Grand Shrine, one of Japan’s most sacred sites. Ishikawa, Kyoto, Nara, and Yamanashi received a two-fold increase in weekly inbound travellers during the Sakura season compared to regular periods. These traveller inflows also generally created an outsized growth in traveller spending, with Nara leading the pack at 180 percent, followed by Kyoto at 150 percent, Ishikawa at 140 percent, and Yamanashi with 110 percent6.

The takeaway for governments, municipalities, and merchants across Japan is clear: while they prepare for a surge in tourism, sparking travellers’ appetite and curiosity will be key to converting footfall into revenues. Hotels and accommodations can collaborate with, and promote cultural hotspots in their area, while municipalities can amplify the visibility of these destinations to make sure travellers put their prefectures in their itineraries.

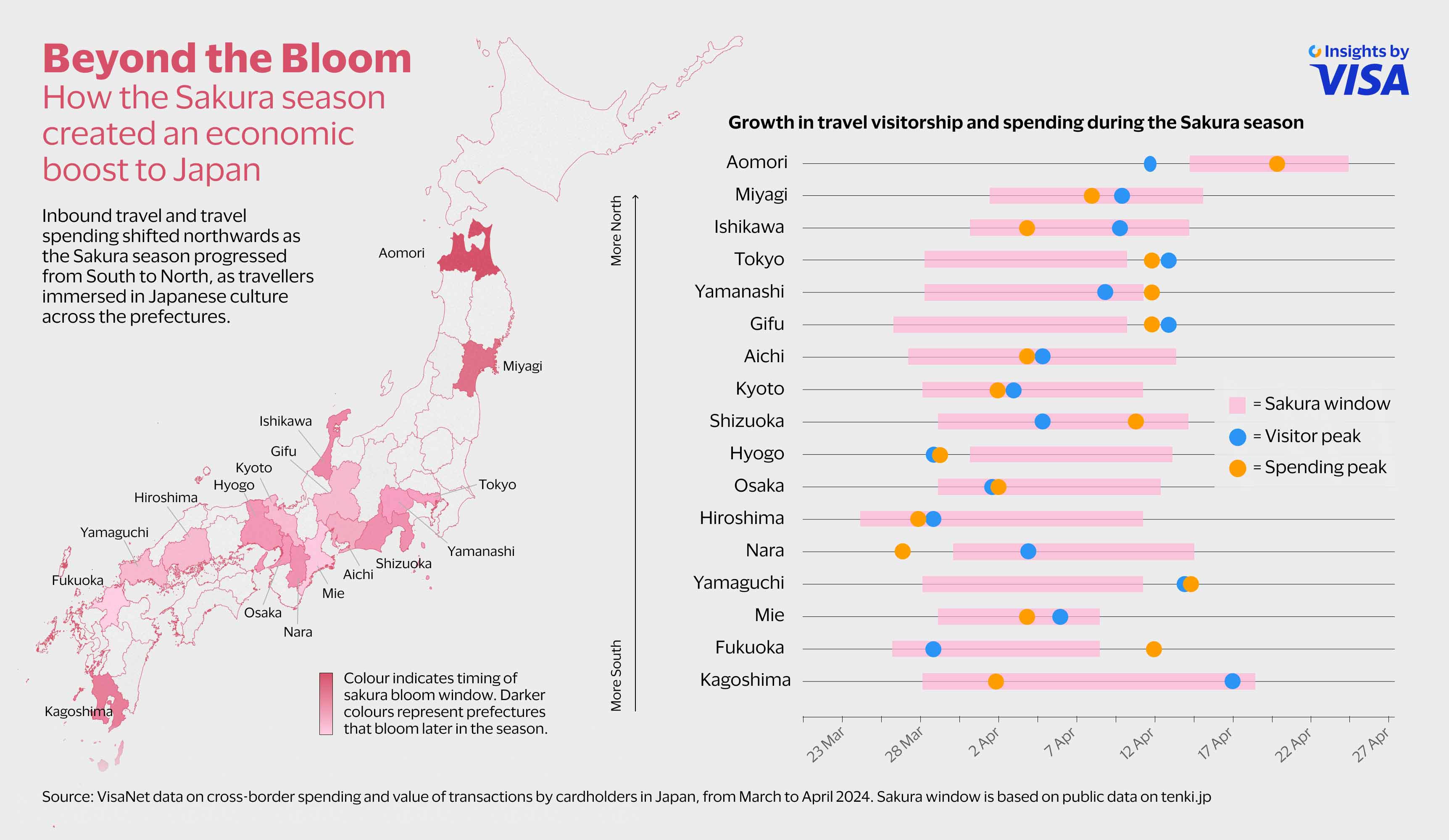

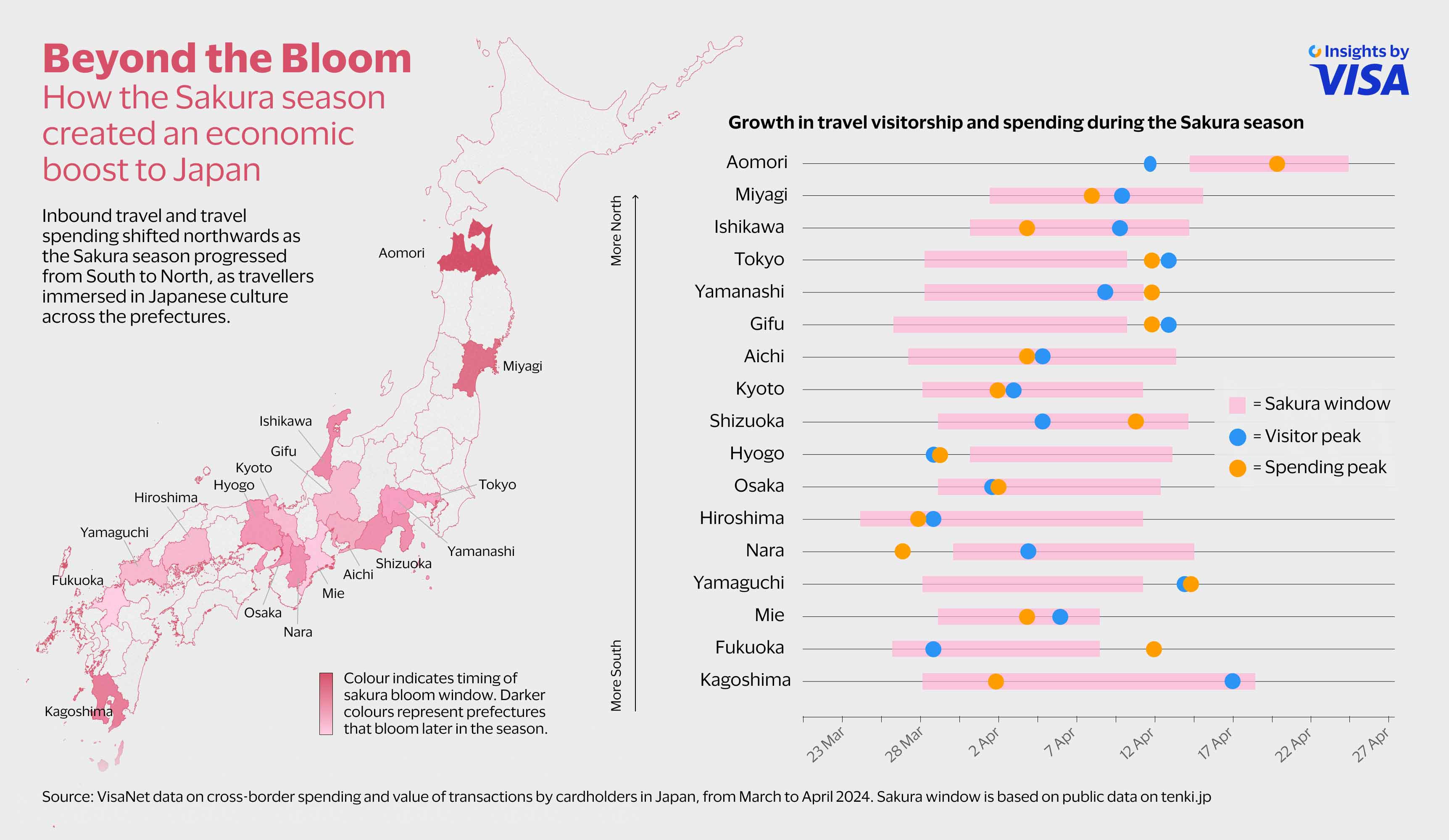

South to North: The best times to capitalise on the Sakura bloom

Visa also analysed traveller visits and spending as the Sakura season progressed, identifying a gradual shift of travel and travel spending from South of Japan to the North from March to May, as travellers pursued the Sakura bloom across the peninsula.

Prefectures in the South, such as Kagoshima, were the first to experience the impact of the Sakura bloom, as traveller spending peaked in early April, while tourism peaked about two weeks later towards the tail end of the season in the prefecture. Overall, traveller spending grew over 70 percent and travel volume spiked 100 percent during the Sakura season in Kagoshima7.

Miyagi, located in the northern reaches of Japan, saw travel and spending peak right in the middle of the Sakura season in the week of 8 April, as travellers timed their visits perfectly to capture the blossoms in full bloom while they explored the sights of the prefecture. Overall, Miyagi saw a 90 percent growth in travellers and an outsized growth in traveller spending of 100 percent, almost double of normal volumes8.

Meanwhile in northernmost Aomori, travel peaked just before the Sakura season began but spending peaked on 21 April, right in the middle of the Sakura season as travellers continued to flock to the prefecture to catch the final cherry blossom blooms of the year.

For city planners and merchants across Japan, timing their offerings for the Sakura season is as important as determining the right mix of products, services, and experiences to offer. With some spending peaking before the Sakura season, it is a sign for accommodations to promote themselves early, up to one or two months before the season begins to capture traveller receipts early in the travel planning stages.

Across the prefectures, travel and spending typically peaks in the first third to the middle of the times when the Sakura flowers boom. This is a sign for merchants and municipalities to focus their promotions during this period, which can draw travellers to their prefectures and inspire further travelling to other prefectures, creating spillover effects as travellers appear to be following the Sakura bloom across prefectures, instead of staying in one prefecture on their trips9.

Visa Destination Insights offers insights on your destination’s international and domestic traveller spending all in one place. With a detailed and customised application based on verified VisaNet transaction data, you can stay on top of the latest travel behaviours that can guide more targeted business decisions.

Uncover travel and payment insights with Visa Destination Insights here.

1 The 17 prefectures are Mie, Aichi, Kyoto, Aomori, Miyagi, Fukuoka, Shizuoka, Gifu, Tokyo, Nara, Osaka, Yamanashi, Ishikawa, Hyogo, Kagoshima, Hiroshima, Yamaguchi

2 VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The term ‘increase’ refers to comparison of the number of trips, characterised by cardholder transactions in merchants in Japan on consecutive days, with no interval exceeding seven days between any two transactions, and the average spending per cardholder in the analysed prefectures from March to April 2024.

3 VisaNet data on inbound tourism spend and transaction count during the Sakura season window, compared to non-Sakura period in the preceding 10 months.

4 Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The term “growth” refers to comparison of cross-border payment volumes by Visa cardholders during the 2024 Sakura window, contrasted against the preceding 52 weeks.

5 Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The term “growth” refers to comparison of cross-border payment volumes by Visa cardholders during the 2024 Sakura window, contrasted against the preceding 52 weeks.

6 Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The term “growth” refers to comparison of cross-border payment volumes by Visa cardholders during the 2024 Sakura window, contrasted against the preceding 52 weeks.

7 Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The terms “grew” and “spiked” refers to comparison of cross-border payment volumes by Visa cardholders during the 2024 Sakura window, contrasted against the preceding 52 weeks.

8 Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The term “growth” refers to comparison of cross-border payment volumes by Visa cardholders during the 2024 Sakura window, contrasted against the preceding 52 weeks.

9 Trip’ is characterized by a series of cardholder’s transactions in Japan merchants occurring on consecutive days, with no interval exceeding seven days between any two transactions.