The Sakura season, where cherry blossoms across Japan are in full bloom, is one of the most anticipated and celebrated events in the country. Millions flock to the peninsula every year to witness the Sakura flowers every year, a time for joy, festivity, and renewal.

According to data on 17 selected Japanese prefectures¹ from Visa, the cherry blossoms create an economic ripple effect throughout Japan, as travellers visit various prefectures to soak in the sight of the flowers and immerse themselves in Japan’s rich culture.

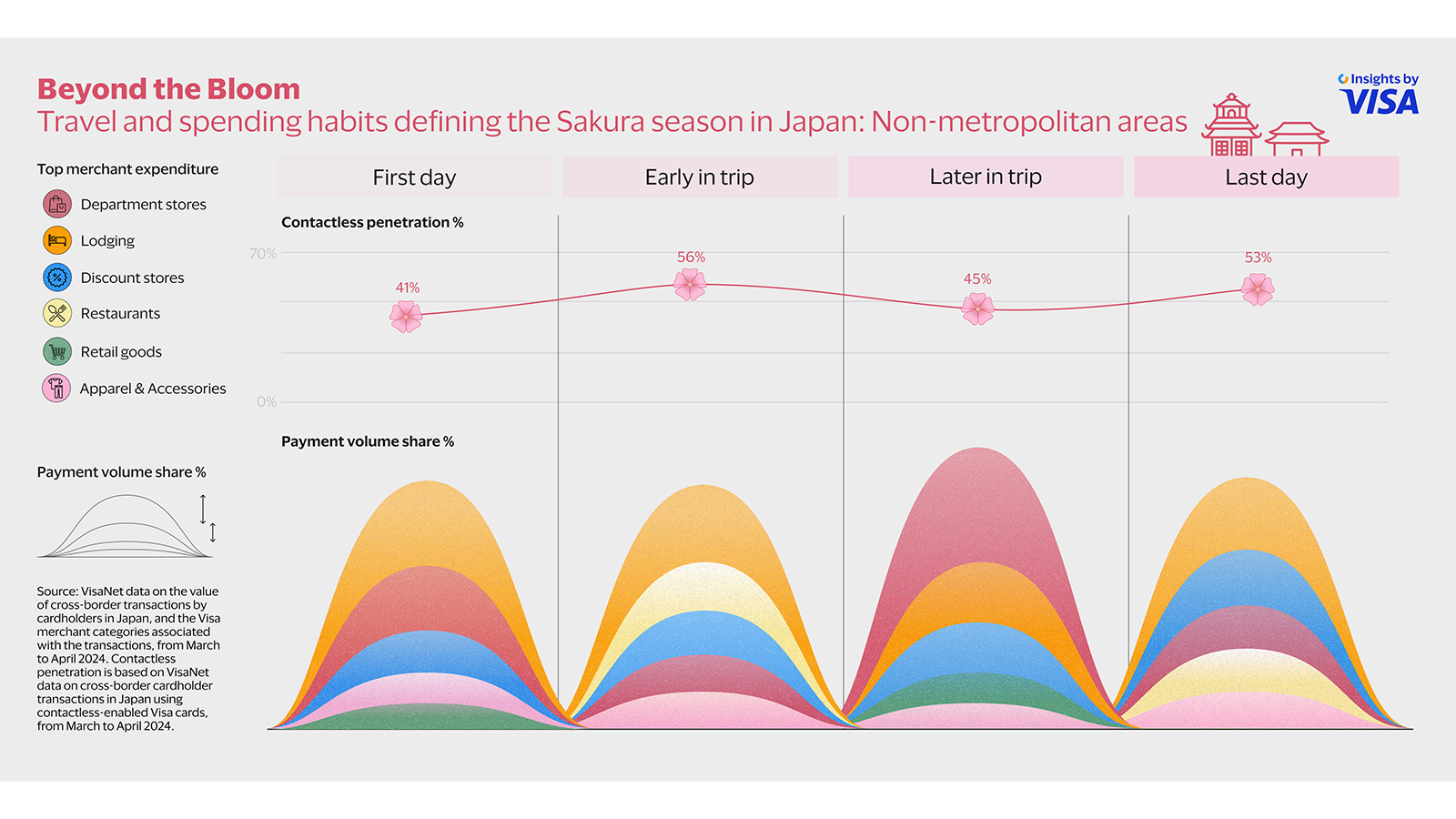

In this second of a three-part series, Visa reveals key patterns in how travellers from various parts of the world travel and spend in Japan as the Sakura flowers bloom, and the emerging habits, marked by the increasing preference for contactless payments, that influence how they plan their expenses across their journey.

As the Sakura season globalises, so must local offerings

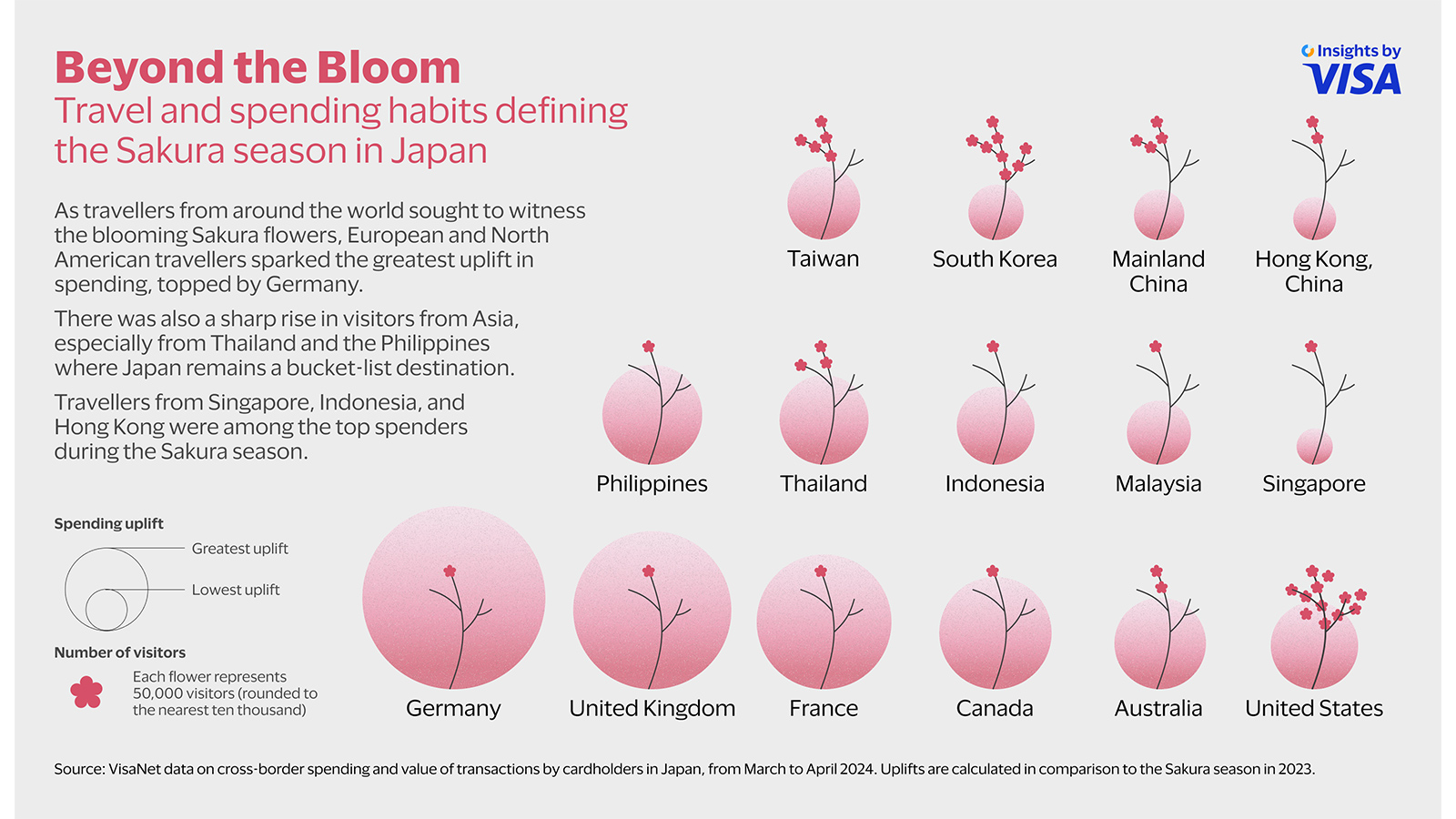

This year, as travellers from around the world ventured to Japan for the Sakura flowers, Visa data found that European and North American travellers attracted the greatest uplift in total spending, led by Germany at 110 percent, followed by the United Kingdom (100%), France (80%), Canada (70%), and the United States (50%)².

Meanwhile, Japan remains popular among travellers from Asia, with significant travel inflows from South Korea, Taiwan, Mainland China, and Thailand. Interest in travelling to Japan is accelerating in Southeast Asia, as more travellers see Japan as a dream destination. The Philippines saw an 85 percent surge in travellers to Japan, with Thailand driving a 50 percent uplift in travellers to Japan, followed by Indonesia (40%) and Malaysia (40%).

The travel bug among Asian travellers also corresponded to a growth in travel spend. Travellers from these regions saw payment volumes grow as much as 43 percent, with Singaporean and Indonesian travellers spending about $1,000 per card. In fact, Asian travellers spend the most per card, with Hong Kong rounding off the top three after Singapore and Indonesia³.

With the Sakura season attracting a cosmopolitan global audience, merchants may find value in adapting their offerings to a wider variety of tastes. Simple language aids, such as having food menus and in-shop signages in English, Mandarin, and Bahasa, may aid the discoverability, trial, and purchase of local products.

For Food & Beverage merchants, adding new menu options, such as more halal-friendly or vegetarian options, may also entice travellers to explore a wider range of Japanese food. The rise of alternative ramen options, such as tori (chicken) ramen broths is one of the ways food operators can seek to do so.

Tailoring offerings to travellers within and outside of Asia

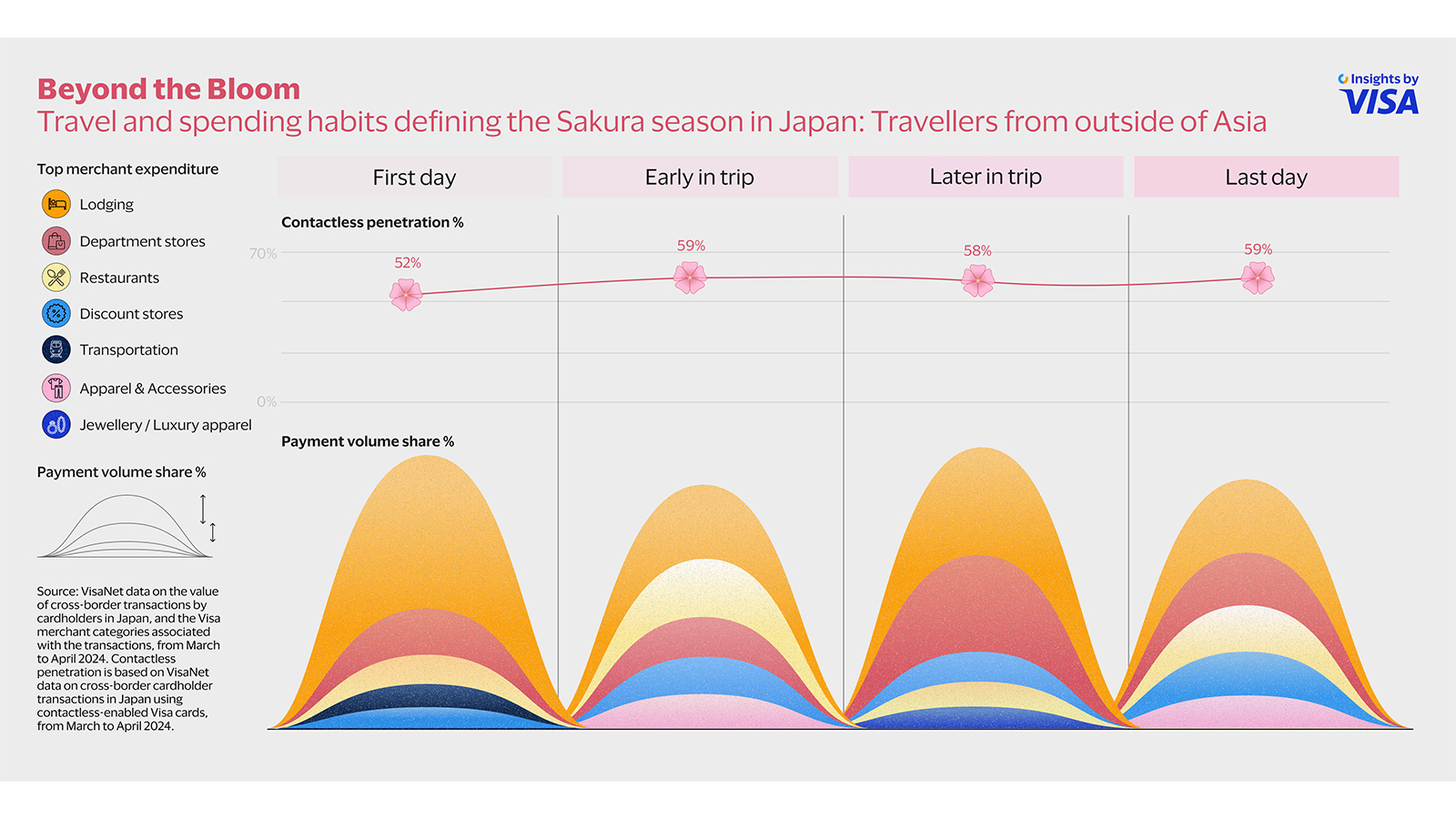

For travellers from outside of Asia, most of whom are making long-haul flights from Europe and North America, most spending in the first day of their trips are on accommodations. This suggests that long-haul travellers are likely to pay for lodgings after they land and are focused on ensuring quality environments for their stay. Visa also found that their trips are twice as long as travellers from Southeast Asia, making lodgings more critical.

In fact, spending on lodging continues to be significant across till the final days of their trips, suggesting that travellers from outside of Asia are making plans for their trips as they adventure in Japan, so hotels and related operators may find value in continuing to market their comfortable lodgings to these travellers.

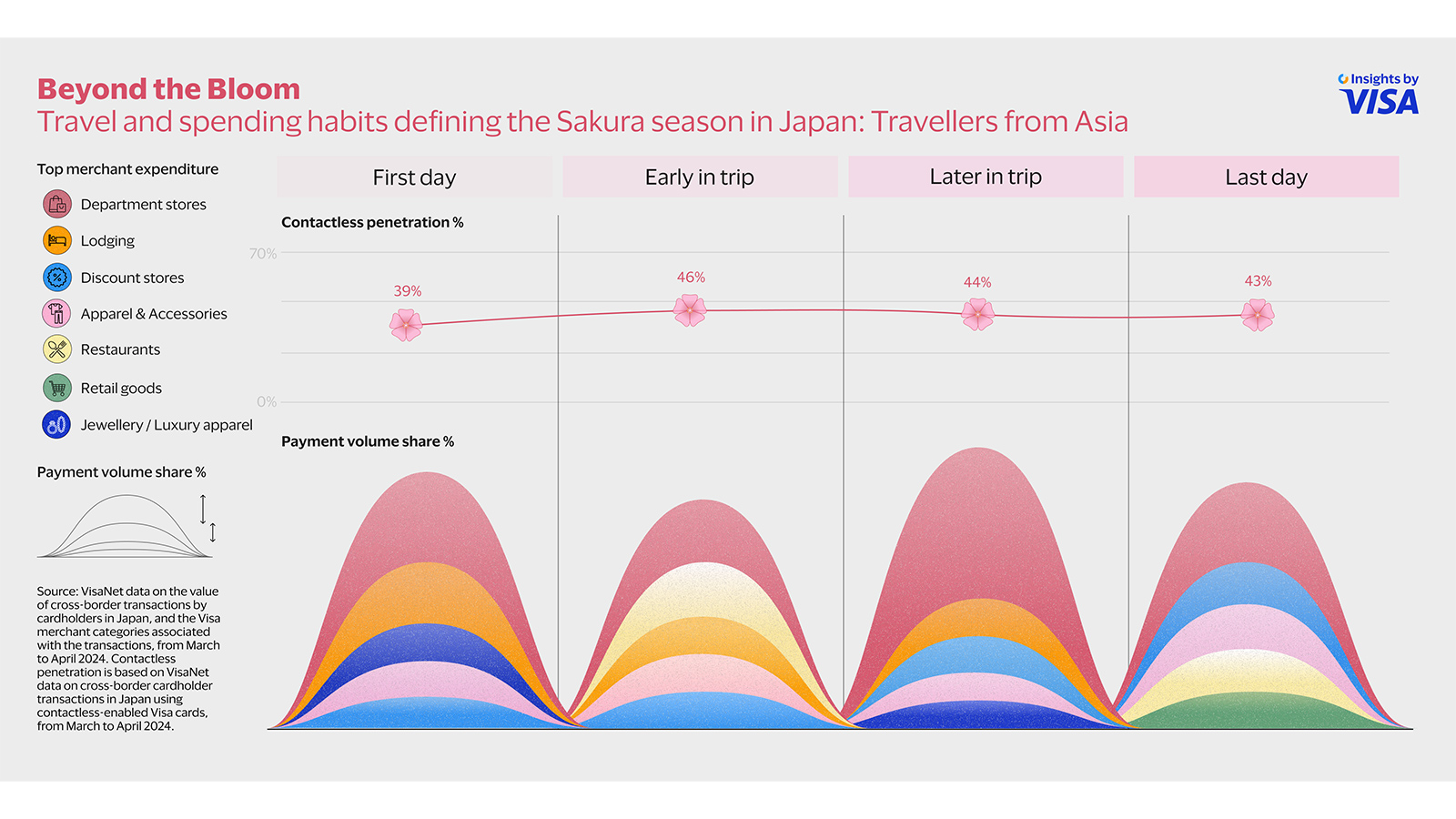

On the flipside, Asian travellers, especially from Southeast Asia, spend a larger proportion of their budgets on shopping. Visa data suggests that they spend about 60% of their budget on shopping, mostly in department stores⁴ Towards the end of their trips, some spending is also kept for discount and retail stores, possibly on duty-free shopping and gifts for their loved ones.

Merchants keen to capture these traveller receipts may want to position their offerings that help travellers better immerse themselves in Japanese culture, such as mementos and gifts for themselves and their loved ones.

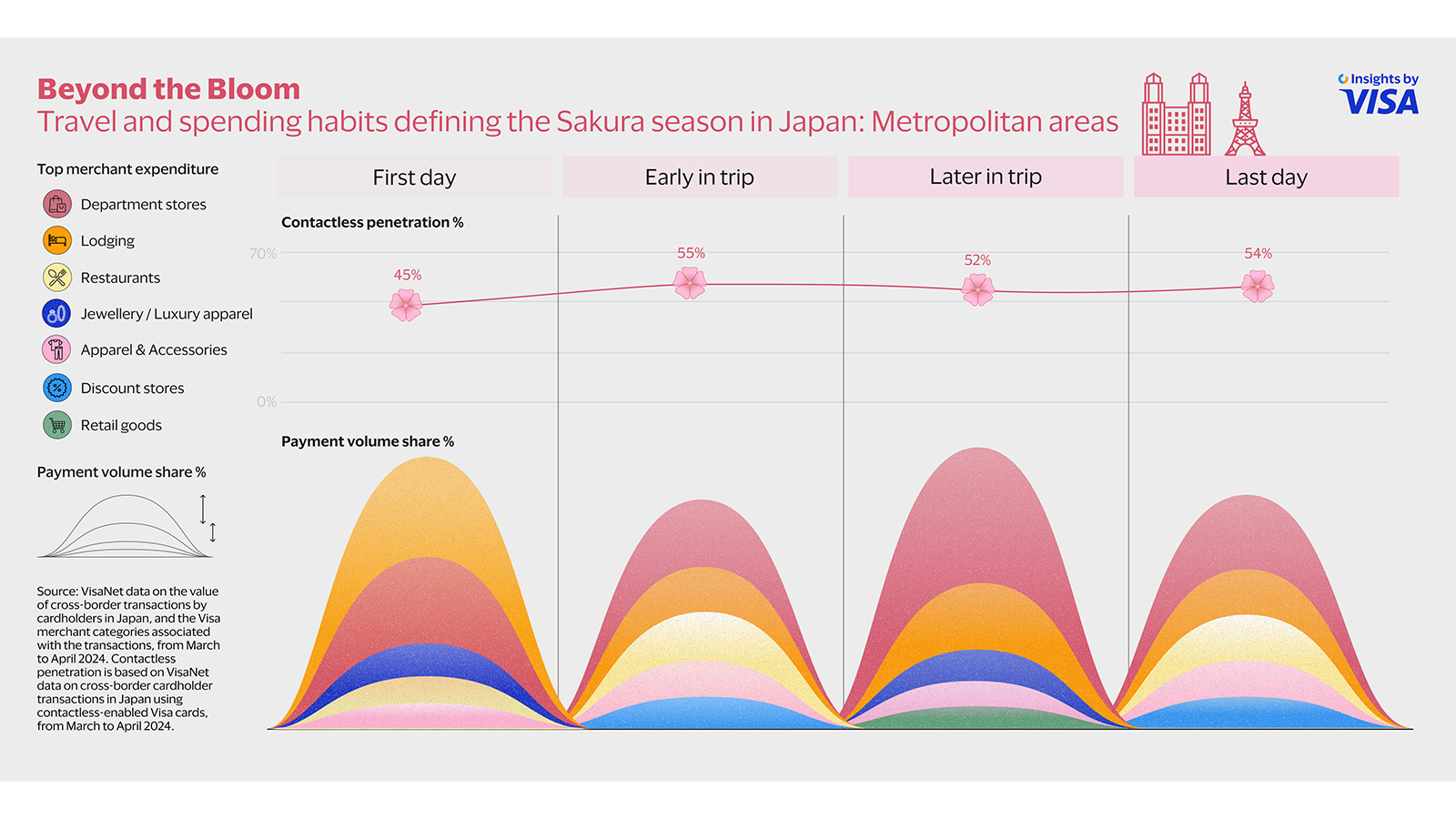

Catering to travellers in metropolitan and non-metropolitan Japan

In comparison, travellers to non-metropolitan areas spend more than 20 percent of their budgets on accommodations⁵, ensuring that their living environments are well taken care of. With dining and local experiences often tied to lodgings such as ryokans (inns), this higher proportion of spending may reflect these local tastes and arrangements.

Visa Destination Insights offers insights on your destination’s international and domestic traveller spending, all in one place. With a detailed and customised application based on verified VisaNet transaction data, you can stay on top of the latest travel behaviours that can guide more targeted business decisions. Uncover travel and payment insights with Visa Destination Insights here.

¹ The 17 prefectures are Mie, Aichi, Kyoto, Aomori, Miyagi, Fukuoka, Shizuoka, Gifu, Tokyo, Nara, Osaka, Yamanashi, Ishikawa, Hyogo, Kagoshima, Hiroshima, Yamaguchi.

² Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. The term "uplift” refers to comparison of cross-border payment volumes by Visa cardholders during the 2024 Sakura window, contrasted against the 2023 Sakura window.

3 Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. Top spender refers to the visitors from a country with highest average spend per trip.

⁴ Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. This spending percentage refers to the average spending per cardholder at specific types of merchants during the specified stages of the trip.

⁵ Source: VisaNet data on cross-border spending and value of transactions by cardholders in Japan, from March to April 2024. This spending percentage refers to the average spending per cardholder at specific types of merchants during the specified stages of the trip.