In a region renowned for its diverse flavours and cuisines, dining out in Southeast Asia can be a delightful experience. Now, it has become a frictionless and cashless experience too: consumers can book a table through an app, arrive at the restaurant using a ride-hailing service, and pay for your ride and food, from your digital or mobile wallet. This trend is now commonplace both in major cities like Bangkok and Singapore as well as smaller towns as mobile and digital wallet usage spreads across the region.

According to the latest Visa Consumer Payment Attitudes study, nearly half of Southeast Asian consumers today are using contactless payments. Among those going cashless, mobile wallets are the most popular with 79% of respondents using them. Mobile wallets are particularly popular in Indonesia and the Philippines where only a little more than half of the overall population has access to bank accounts. In Indonesia, 92% of respondents reported using a mobile wallet with the Philippines and Malaysia not far behind at 87%.¹

In a region home to about 700 million consumers,² the increasing popularity of digital wallets is tied to the phenomenal growth in smartphone adoption. At 84%, Southeast Asia has the second-highest rate of adoption in Asia Pacific, a figure that is expected to rise to 93% by 2030.³

Mobile wallets offer a convenient and safe way to store and spend money, and for people without access to bank accounts, they are a critical avenue to access and be an integral part of the region’s robust and resilient economy.⁴ Consumers can use their mobile wallets for a host of transactions — from settling bills to paying for transportation to stock investing. For micro, small and medium-sized enterprises accepting mobile payments, they can benefit by serving the growing market made more accessible by a burgeoning digital economy and have a safer alternative to holding cash daily.

Cards are still crucial amid digital wallet adoption

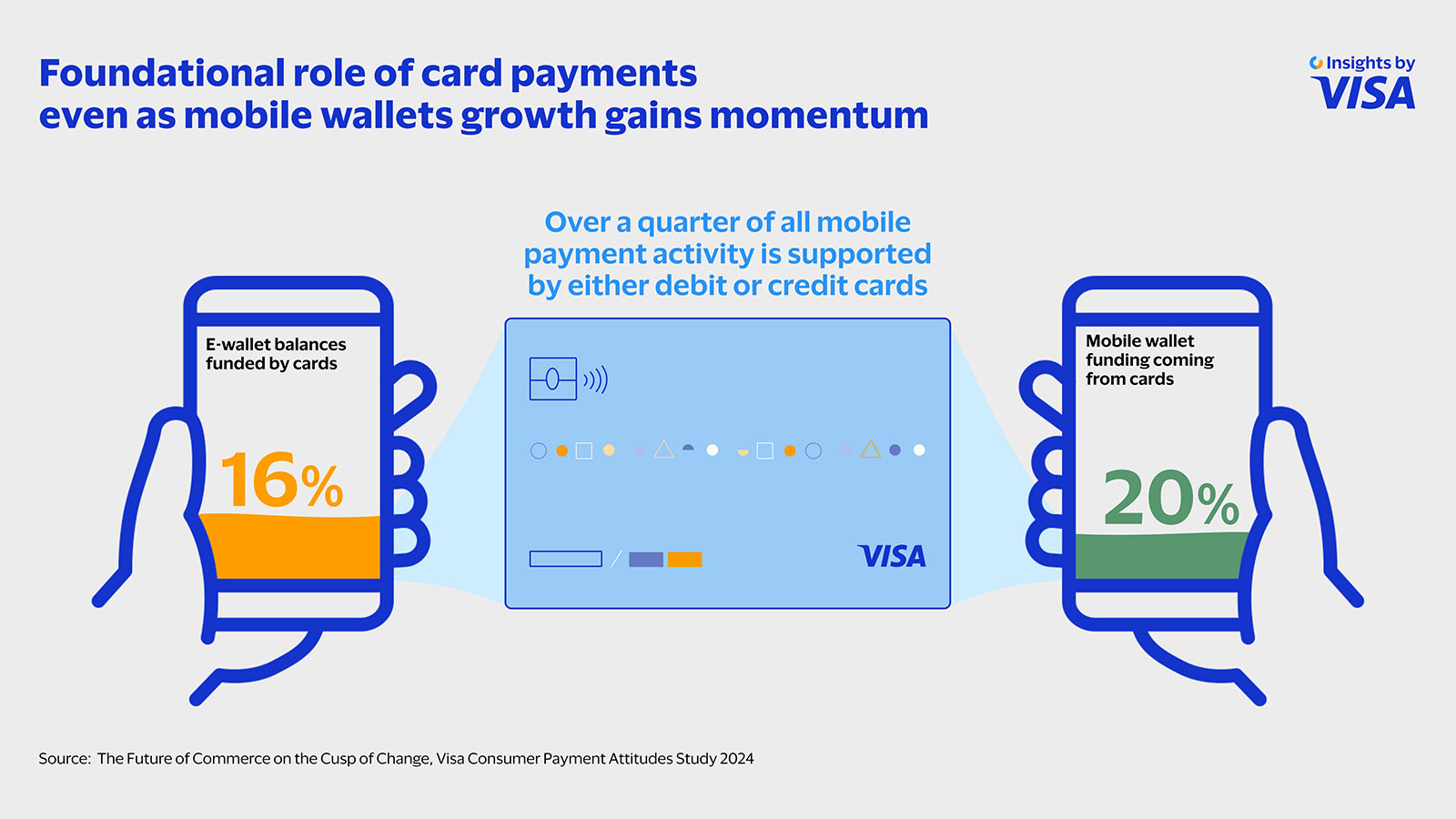

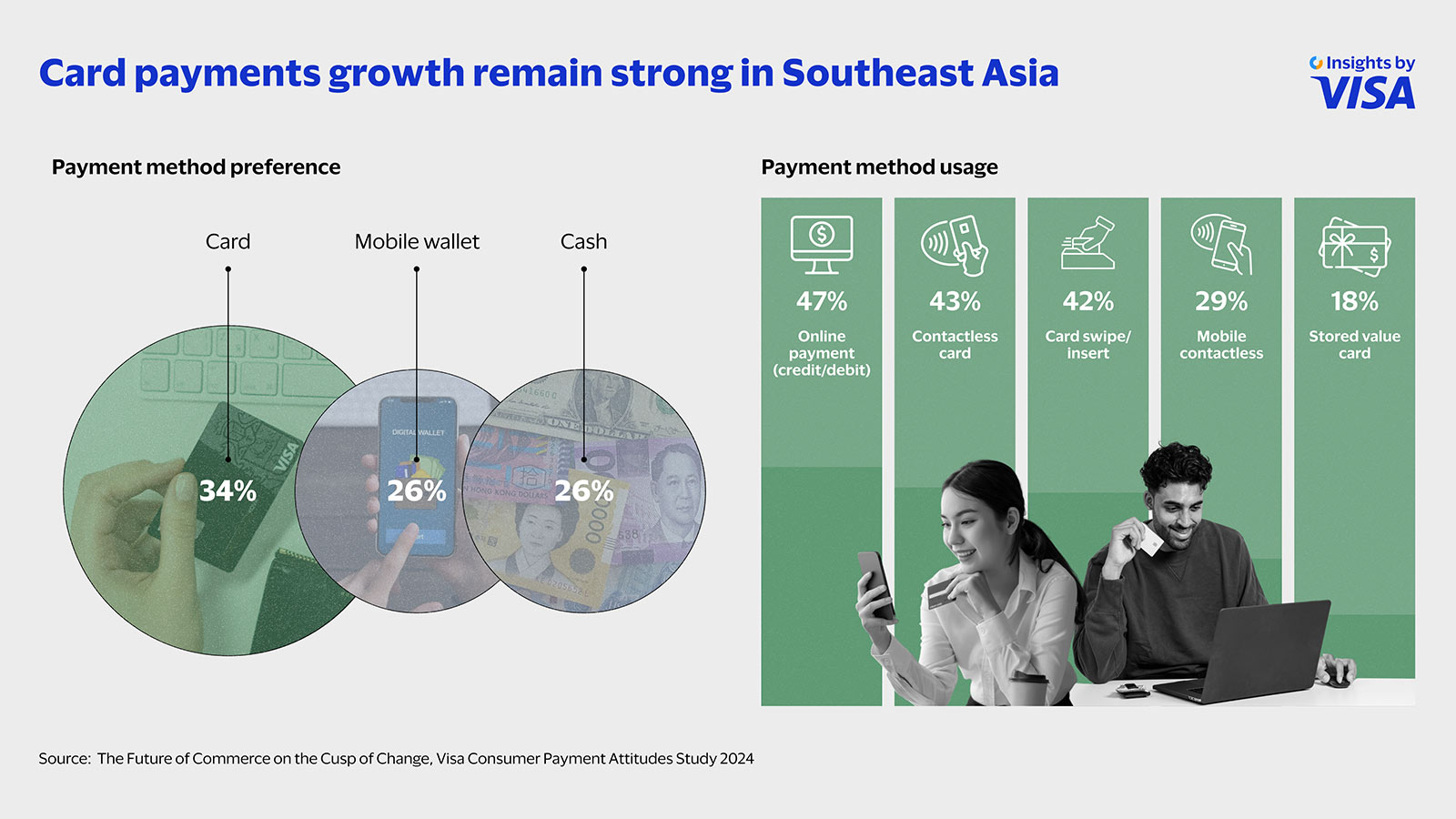

To be sure, even as digital wallet adoption is rising, more established means of payments, such as cards, are not going away. This is because mobile wallets are not payment sources by themselves, as they rely on a bank account, credit card or debit card, or a combination of these, to fund payments.

According to our study, over a quarter of mobile payment activity in Southeast Asia is funded by credit or debit cards. Previous research by Visa has found that 1 in 3 consumers applied for a new card in the first half of 2023, with 43% doing so to integrate them into their mobile wallets.⁵ In this way, cards and digital wallets are converging and co-existing.

Visa’s established digital payments infrastructure, for example, plays an integral role in encouraging cashless transactions. Credit and debit cards offer consumers a strong security infrastructure, protecting them from fraud risk, for example. At the same time, linking payments to cards makes transactions easier as consumers can have their card information saved on file, avoiding the time-consuming process of keying in personal information for each transaction. The ability to link trusted cards to digital wallets enables the growth of cashless payments as consumers enjoy the flexibility they seek and secure access to the funding source that fits their needs.

Beyond commercial uses

Not only are cashless payments here to stay in Southeast Asia, their use is also expanding beyond the commercial realm. In the public sector, the ongoing shift to cashless payments has given impetus to the use of digital wallets for distributing government financial assistance, for example – pushing and implementing national digitalization agendas faster to catch up with consumer demand and preferences.

Mobile wallets allow government agencies to bypass inefficient aid distribution methods like bank transfers or physical vouchers without the need for extensive financial infrastructure investments. For example, as countries move towards real-name mobile number registration,⁶ each number is associated with a verified user, streamlining the verification process.

In 2023, to help Malaysians cope with inflation, the government provided MYR1 billion (US$212 million) in financial assistance to 10 million citizens via four participating mobile wallet service providers.⁷ This year, the Thai government proposed to provide US$14 billion worth of handouts to 50 million citizens via digital wallets.⁸

Cross-border connectivity is another goal governments seek to achieve using digital wallets, to support greater convenience for travelers, as well as faster and cheaper international transfers. The central banks of Indonesia, Thailand, Malaysia, Singapore, and the Philippines signed a memorandum of understanding in 2022 to make interoperable regional payment connectivity a reality by 2025.⁹

As digital wallets use cases proliferate, they are bound to support more innovation and advances across the ecosystem. Completing the other half of the picture, cards, with their established infrastructure and convenience, remain the backbone for digital wallet growth in Southeast Asia, helping to drive financial inclusion and economic development in one of the world’s biggest consumer markets.

¹ Visa Consumer Payment Attitudes Study 2024

³ GSM The Mobile Economy Asia Pacific 2023

⁴ https://www.adb.org/outlook/editions/april-2024

⁵ Visa Green Shoots Radar Wave 11

⁶ https://www.comparitech.com/blog/vpn-privacy/sim-card-registration-laws/

⁷ https://www.mof.gov.my/portal/en/news/press-release/rm1-billion-allocated-to-emadani-to-benefit-up-to-10-million-malaysians; https://www.mof.gov.my/portal/en/news/press-citations/rm100-e-wallet-assistance-will-be-distributed-december-this-year-steven-sim