Visa’s latest Visa Consumer Payment Attitudes study confirms an unstoppable trend in Southeast Asia: the region’s consumers want a cashless future.

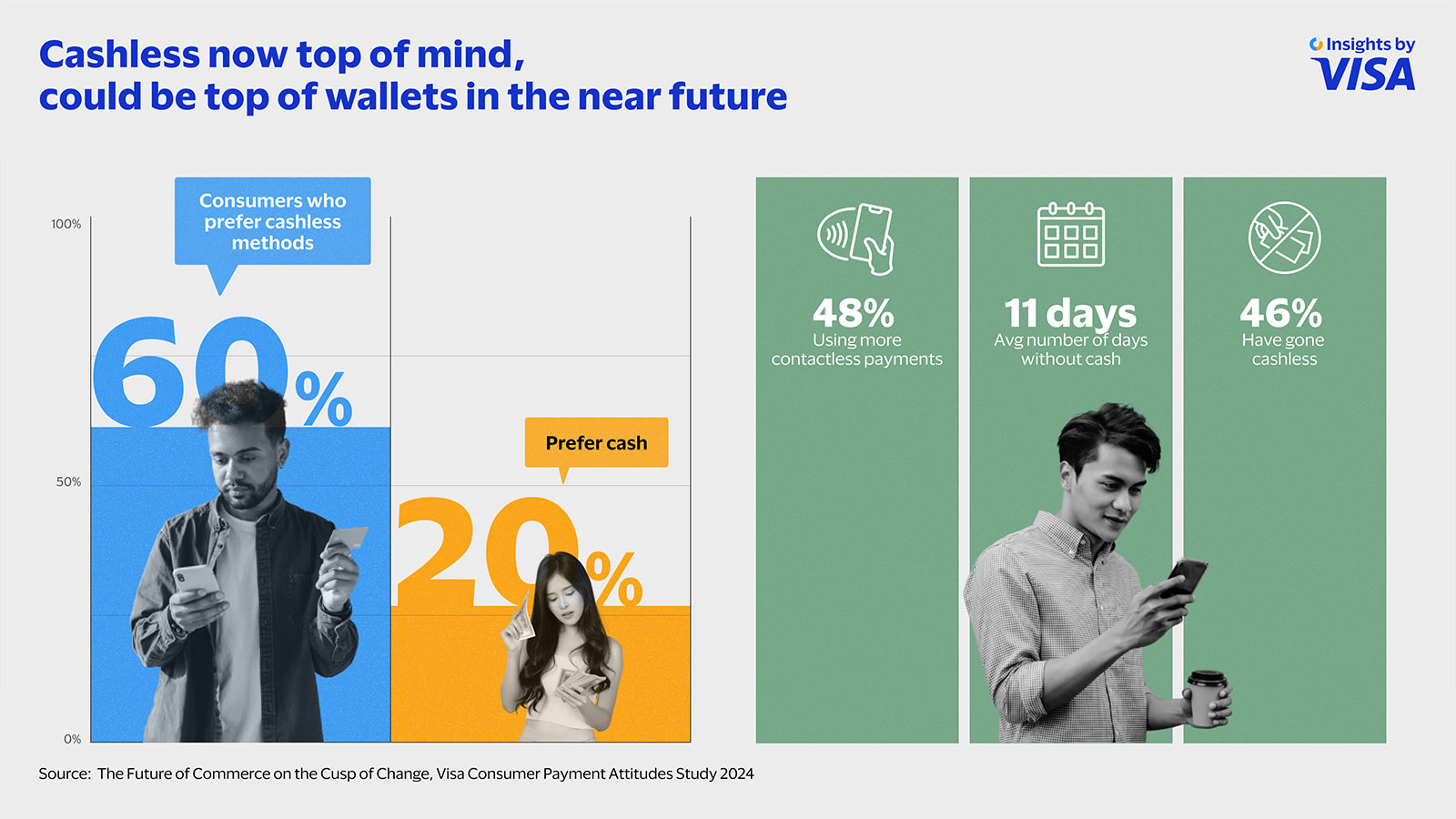

In nearly a decade of tracking payment trends in Southeast Asia, our latest data show a clear shift in consumer mindset: 60% of those surveyed said they prefer to go cashless. Last year, more than 70% made do without cash, some for as long as 11 days, as they tried out new payment technologies.

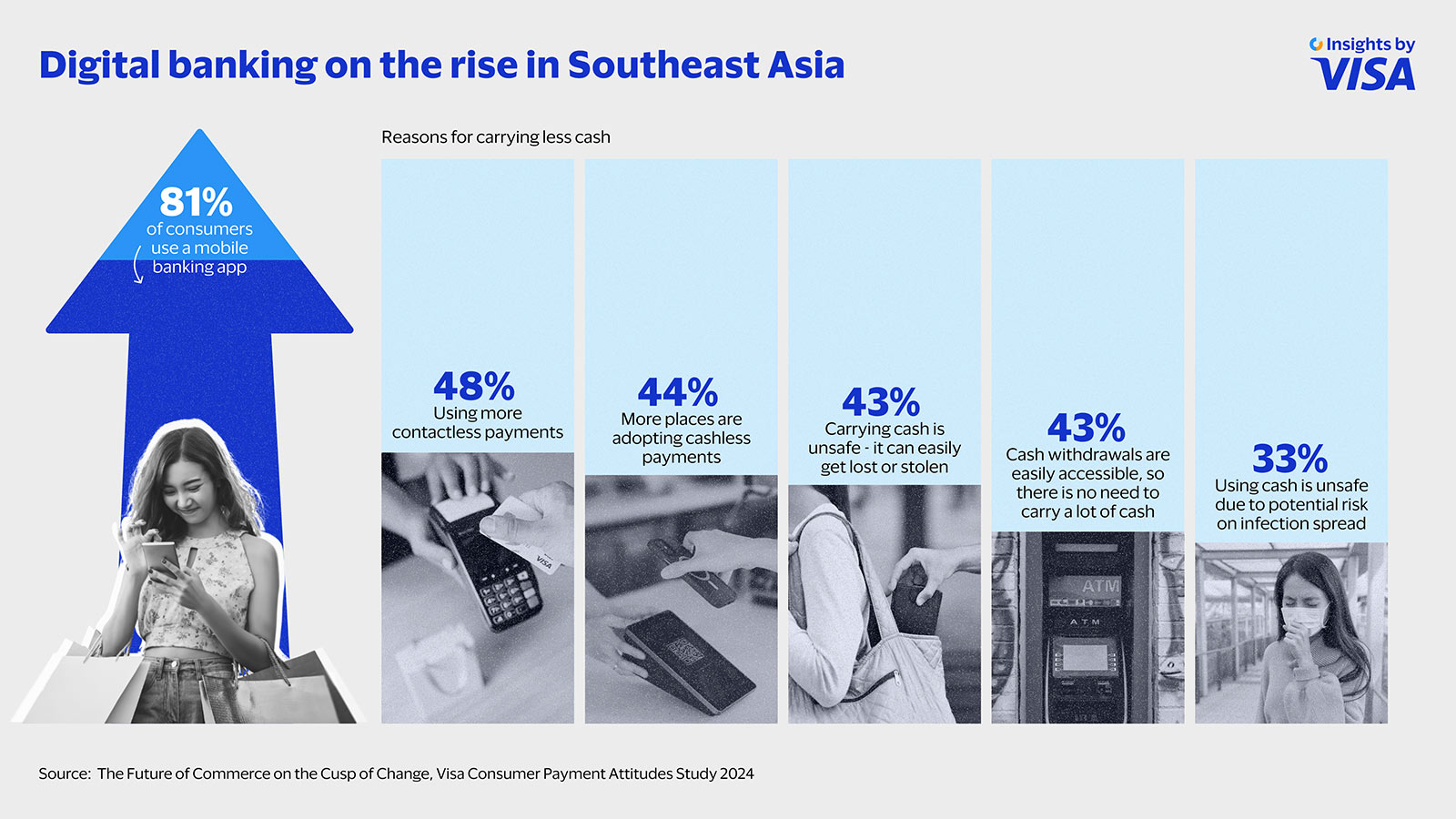

Although digital payment systems have been around for a while, it was the social distancing necessitated by the COVID-19 pandemic that entrenched the need for contactless payment solutions. Our survey of more than 6,550 consumers across the region showed that nearly half of Southeast Asian consumers today are using more contactless payments, citing it as the top reason for carrying less cash.

Despite their growing comfort with cashless transactions, however, cash can still be found in people’s physical wallets as it retains a slight lead over cashless payments as a payment method in terms of overall usage and frequency of use. This partly reflects the economic realities and the varied pace of development in financial services infrastructure across the region. For example, respondents in advanced economies like Singapore and Malaysia were more likely to go cashless.

Cards continue to lead cashless choices

But overall, preference for cashless payments continues to grow in Southeast Asia, drawing consumers from new economic segments and demographic groups who are attracted to the convenience, access, and security offered by cards, e-wallets, and other digital payment modes.

For example, digital or mobile wallets and real-time payments (RTP) have gained popularity and their adoption is often supported by governments and financial institutions. Meanwhile, mobile wallet use continues to surge, especially in Indonesia and the Philippines, where just a little over half the population has access to bank accounts.

Still, according to the Consumer Payment Attitudes study, credit or debit cards take the top spot (34%) as the preferred form of payment while mobile wallets (26%) and cash run neck and neck in second place. The popularity of cards is set to endure for many reasons, including reward programmes, payment flexibility and extensive merchant acceptance.

For instance, Visa and other contactless credit and debit cards are now widely accepted by public transportation operators in major cities like Sydney, Singapore, and Hong Kong¹. With increasing use cases in everyday life, cards can play an integral role in the cashless society, especially as they can also be seamlessly integrated into digital wallets as a funding source.

The study also indicates that the growing acceptance of cashless payments among merchants (44%) is reinforcing cashless usage among consumers, and consumers themselves have observed a marked increase in cashless payments acceptance, particularly in the dining, retail and groceries segments over the last 12 months. This is a win-win for both consumers and merchants. Consumers enjoy the convenience and security of cashless payments, while a more seamless, faster shopping or dining experience builds customer loyalty, increasing sales as well as potentially attracting new types of customers.

Connecting more of the unbanked

Consumer preferences could change further as emerging technologies reshape the fundamentals of how consumers pay. The rise of digital or virtual banks, for example, has further broadened the cashless ecosystem. More than 80% of consumers in the study reported using a mobile banking app, a trend that has accelerated as digital banks aid the proliferation of online-only banking.

Some online-only financial institutions, such as GXS Bank and Trust Bank in Singapore and AEON in Malaysia, have their own banking license, allowing them to offer a wider range of products and services.² Others like TNEX and Timo in Vietnam have partnered with traditional lenders.³ It is also common to see cross-sector partnerships supporting these banks – GXS Bank, for example, is backed by Grab and Singtel, while Trust is a joint venture between Standard Chartered and the FairPrice Group,⁴ which can make their offerings attractive and friendly for consumers.

A standout benefit of such online banks is that they improve inclusivity by allowing the millions of unbanked or underbanked in Southeast Asia to digitally access basic financial services for the first time. Even those without a credit history can open accounts, apply for cards and loans, take advantage of buy-now-pay-later (BNPL) schemes, and invest in wealth and insurance products – potentially inviting more people to contribute to the economy. These online banks, which tend to be focused on developing fintech applications, are already gaining appeal with tech-savvy Gen Z and millennial consumers looking for increased convenience and a seamless experience in managing their finances.

Indeed, Visa’s nine years of consumer payment monitoring tells us that cash is quickly being replaced by digital payment methods. As the region’s cashless future gains momentum, more digital payment methods are expected to emerge and consumers are likely to be big winners as they enjoy diverse options for spending their money, as well as more personalised and rewarding experiences.

1 TransportNSW, MTR Corporation, and Visa SG websites, accessed 29 May 2024

² https://fintechnews.sg/74448/digital-banking-news-singapore/a-list-of-digital-banks-in-asia/; https://www.bnm.gov.my/-/digital-bank-5-licences

3 https://mambu.com/customer/tnex; https://timo.vn/en/blogs-en/news-and-deals/timo-is-moving-to-new-banking-partner/

⁴ https://www.stashaway.sg/r/singapore-digital-bank-trust-bank-review; https://www.gxs.com.sg/