The Singapore Night Race has been a jewel in the annual racing calendar since it started in 2008. The first of its kind in the world, its popularity has inspired more night races around the world, with Las Vegas being the latest to try and emulate its success. The race adds to Singapore’s sparkle as a tourism and economic hub in Asia. The Singapore government estimated the race to have added US$1.5 billion in incremental tourism receipts since 2008¹, while half of race goers are foreign as the world descends on an island 1% the size of Texas.

After another thrilling race this year, Visa dove into its vast payments network to unpack the key numbers that make the Singapore Night Race a true sporting spectacle and growth engine for the island country and Asia.

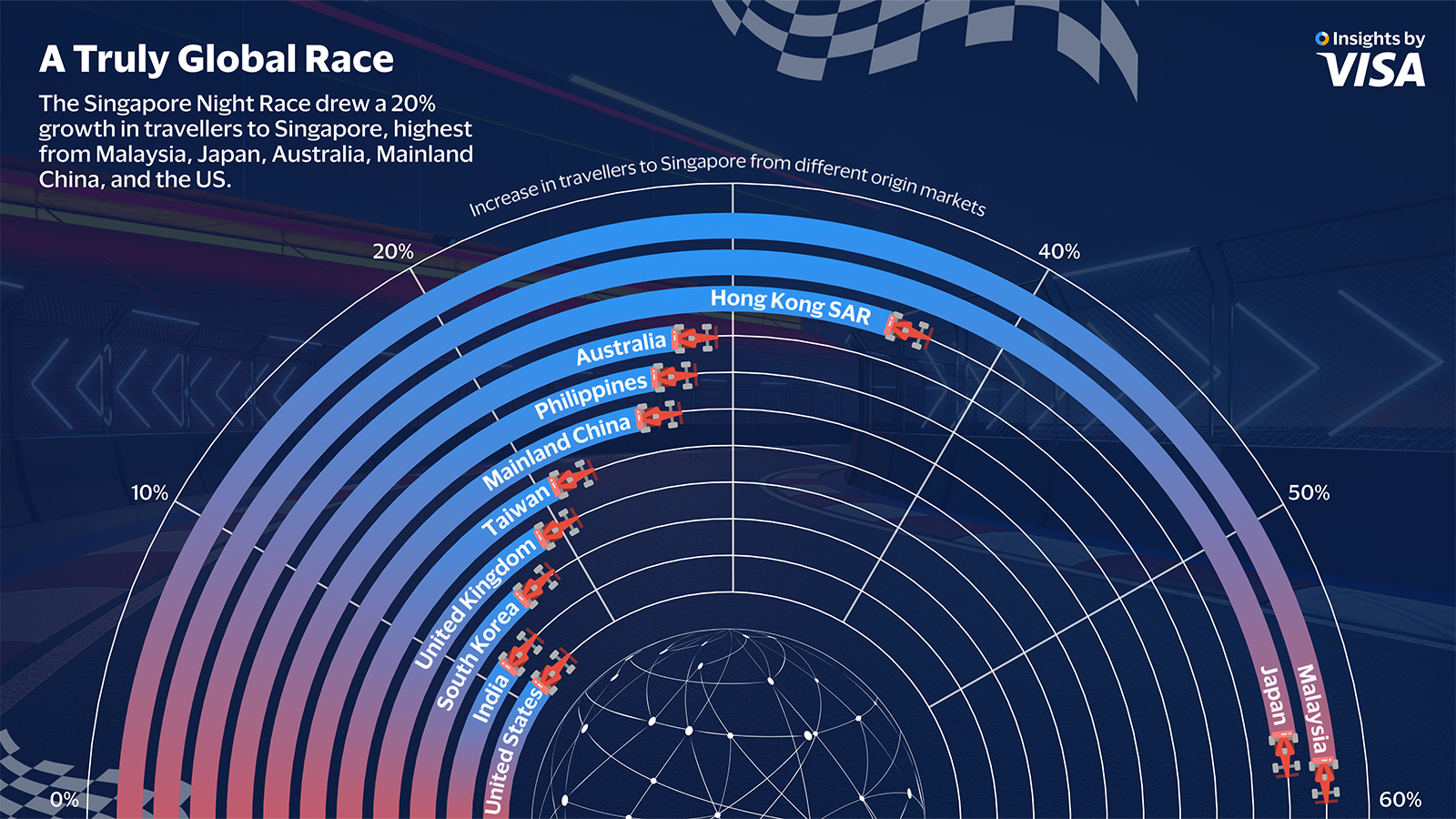

A truly global race

This year, the Singapore Night Race once again attracted travellers from around the world. While Asian travellers unsurprisingly accounted for the bulk of growth, the race week also saw travellers from Europe, North America, and other parts of the world descend into Singapore. Based on Visa data, the week of the race saw the number of foreign travellers into Singapore grow by over 20% compared to a typical week.²

Hong Kong SAR, Japan, and Malaysia led the tourism surge with over 50%³ more travellers visiting Singapore on the week of the race, emphasising the regional allure of the race. These travellers spent over 50% more in Singapore during the week, as the spike in tourism landfall also generated business for merchants across the island.

Australia, Mainland China, and the United States also saw a significant surge in travel and spending during the race week. The long flight was no obstacle for Formula 1 fanatics in the US, as 10% more travellers from the country visited Singapore with over 40% surge in traveller spending⁴. Meanwhile, the number of travellers from Australia and the United Kingdom grew by over 40% and near 30% respectively, resulting in a spending increase of near 90% and 80% respectively⁵.

Collectively, these five markets accounted for over 40% of travel spending⁶ in Singapore during the night race, signalling a sales and marketing opportunity for merchants to perhaps tailor some of their products and offerings to the tastes of these consumers.

Another key finding was the attraction of the night race for high-net-worth travellers. According to Visa cardholder data, these travellers made up about one-third of all tourist inflows into Singapore during the race week, more than 70% higher than an average week¹. This increased high-net-worth footfall into Singapore translated into an over 70% increase in their spending², representing an opportunity for merchants in the luxury and premium segment.

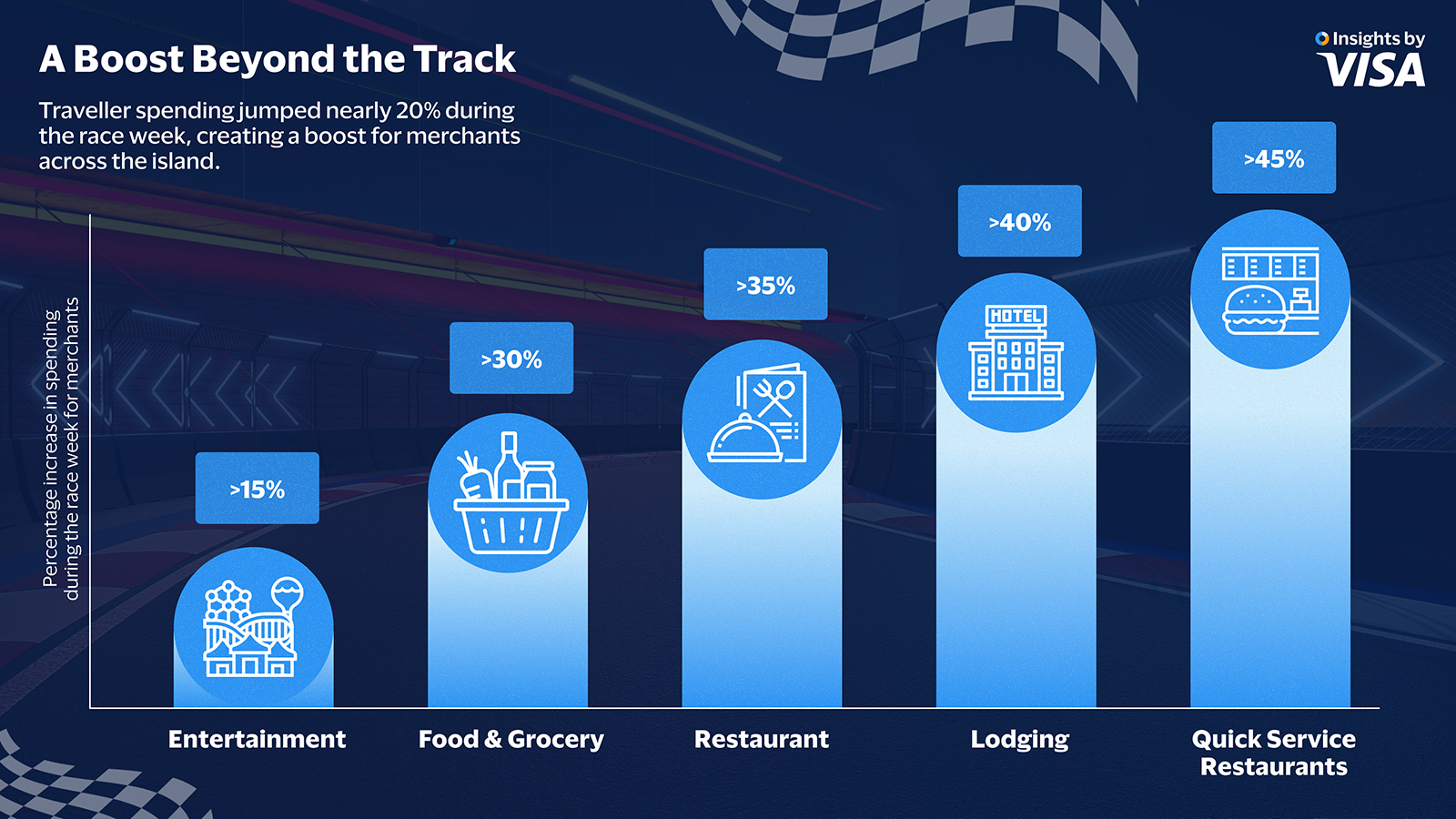

A boost beyond the track

Diving deeper into data on spending patterns, Visa also uncovered specifically how the surge in travel created a boost to the island’s businesses and the economy. Visa’s data showed that during the race week, travellers spent over 30% more in Singapore³, with the travel landfall delivering a boost to merchants in the country.

The increase in spending was greatest for merchants in Entertainment, as travellers sought to soak in the fun on the island. Restaurants, especially Quick Service Restaurants like fast food outlets also saw a significant surge in sales with travellers immersing in Singapore’s famous food culture or grabbing a bite in between the weekend races.

Making the rest of the top five were Lodging (>45%) and Food & Grocery (>30%)¹, likely a sign that guests living in hotels surrounding the racetrack were loading up on snacks and beverages to enjoy while watching from the comfort of their rooms.

A less-heralded impact of sporting events like the Night Race is its impact on local businesses, especially small and medium-sized businesses (SMBs). In fact, during the race week, local SMBs experienced an approximate 10% spending uplift, and over 50% when zooming into traveller spend alone.²

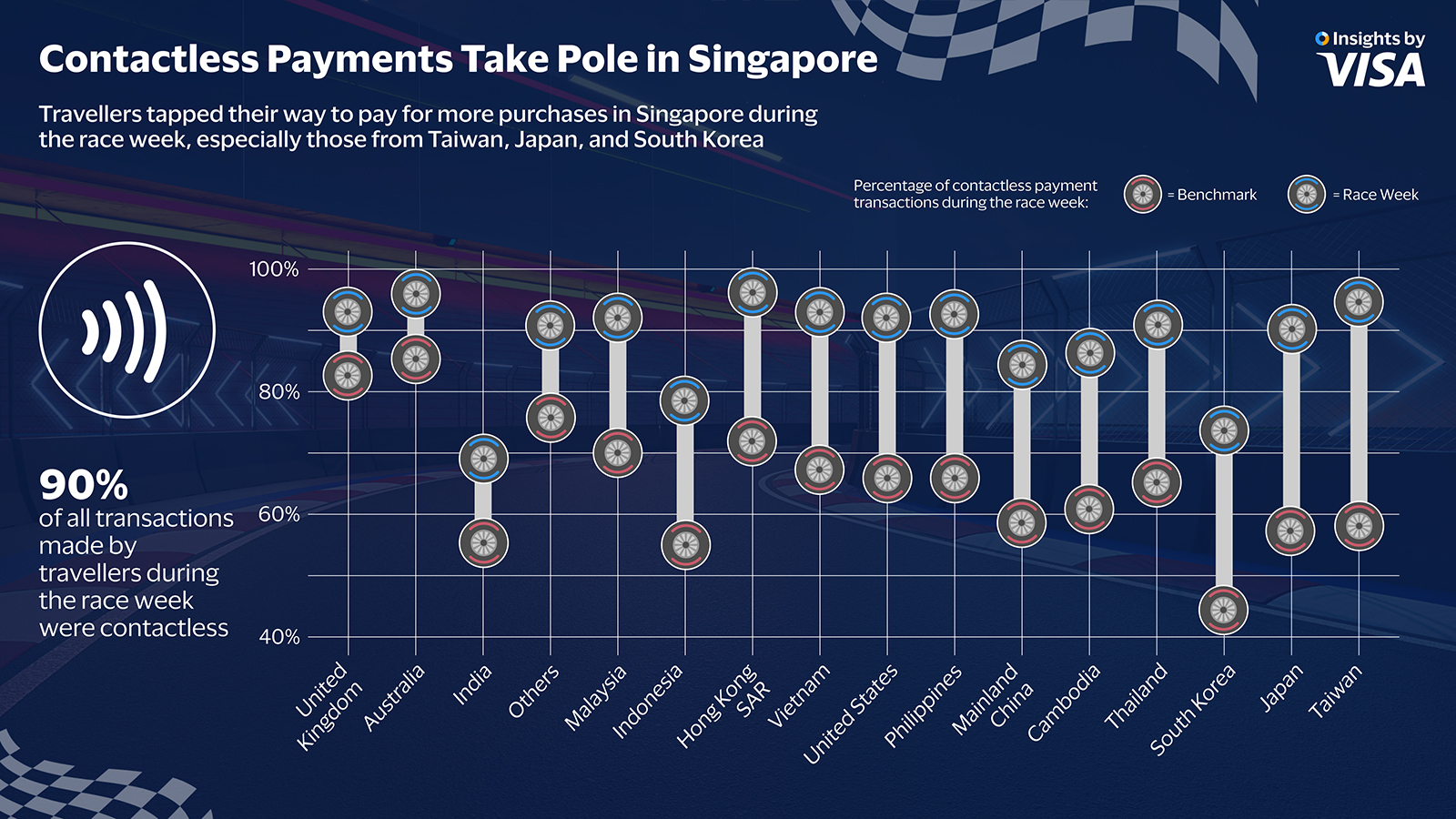

Contactless payments take pole

Beneath the surge in travel spending, Visa’s data during the Singapore Night Race week reaffirms a continued shift to contactless payments among travellers not only in Asia, but across the world. Across all origin markets analysed, travellers paid for their purchases in Singapore during the race week with contactless payments more often than they were on other trips – aided by the availability and adoption of contactless terminals by merchants, from established retailers at the heart of town to SMBs across the island.

In total, close to 90% of travel transactions during the race week were made contactlessly , with the sharpest uplift seen among travellers from Taiwan (over 35%), Japan (Over 30%), and South Korea (close to 30%) . Other origin markets with a significant boost in contactless spending were Thailand, the Philippines, Mainland China, and Cambodia.

The data suggests that contactless payments can help merchants capture a larger chunk of travel spending. With growing appetite and use of contactless payments by travellers, merchants that act fast to adopt it can convert high-intent travellers to customers by making it easier for them to pay for products and services they discover in store. Financial institutions can accelerate adoption by speeding up education and promoting contactless-enabled terminals among merchants, turning improved conversion and sales into revenue.

The Singapore Night Race continues to prove itself as more than a sporting event. It is a powerful economic driver that ignites Singapore’s tourism sector and creates a boost to merchants across the island. Businesses that best decode the payment patterns can put themselves at the front of the race to benefit from one of Asia’s foremost sporting celebrations.

Visa Destination Insights offers insights on your destination’s international and domestic traveller spending all in one place. With a detailed and customised application based on verified VisaNet transaction data, you can stay on top of the latest travel behaviours that can guide more targeted business decisions.

¹ Source: The Straits Times, Over $44,000 for a week in S'pore to see F1? No sweat: Racegoers splurge for a weekend to remember | The Straits Times, accessed 26 September 2024

² Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

³ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

⁴ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

⁵ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

⁶ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

⁷ Identified by the product types Visa Infinite and Visa Signature for all countries except Japan (Visa Gold & Visa Platinum in Japan). Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

⁸ Identified by the product types Visa Infinite and Visa Signature for all countries except Japan (Visa Gold & Visa Platinum in Japan). Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

⁹ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

¹⁰ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

¹¹ Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore. Figures compare the period from 14 to 20 September 2024, with the monthly average of the preceding 12 months.

¹² Figures compare the period from September 14 to 20, 2024 of contactless transactions by cardholders not from Singapore, with the monthly average of the preceding 12 months. Contactless payment usage means the percentage of total card present transactions made by contactless.

¹³ Figures compare the period from September 14 to 20, 2024 of contactless transactions by cardholders not from Singapore, with the monthly average of the preceding 12 months. Contactless payment usage means the percentage of total card present transactions made by contactless.