Across a rapidly urbanising Asia Pacific, public transport forms the backbone of people’s lives and the region’s economy. Therefore, improving access to and usage of public transport has become a priority for cities trying to optimise people movement while battling congestion and pollution.

A major hurdle to boosting ridership is the lack of seamless payment experiences across different modes of public transit. Almost half of public transport riders in Asia Pacific use four or more different payment methods each month, according to Visa’s Global Urban Mobility survey in 2023.

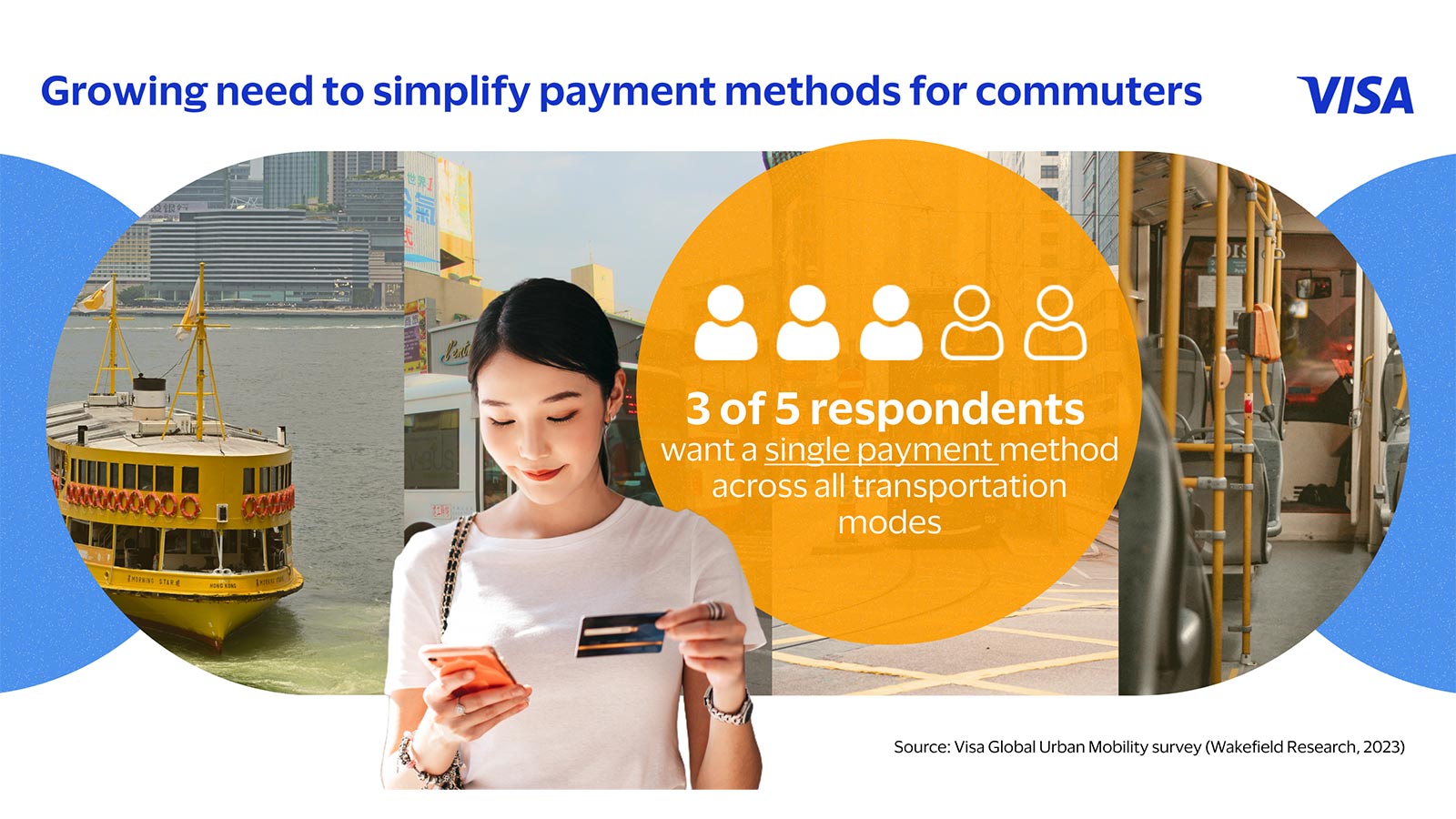

Rather than juggle multiple cards and cash and spend time on top-ups, commuters in the region increasingly want the convenience of a single payment method that they can use on trains, buses and ferries for a smooth journey. Three out of five respondents in the Global Urban Mobility survey said they would make more use of public transport if there was a simple and single payment method across the modes.

Urban planners and transport authorities are taking note. There is growing momentum for open-loop payment systems that use universal technology which have become key for urban mobility solutions that aim to provide efficient, safe and sustainable travel experiences while also easing challenges.

Open-loop vs closed-loop technology

Open-loop technology enables this and underpins the concept of Mobility-as-a-Service, which integrates planning, booking and paying for trips in one app or platform. It relies on account-based ticketing (ABT) architecture that links the rider to a single personal account such as an everyday credit card. Account information and fare transactions are managed by back-end servers and calculations are based on actual use.

By contrast, closed-loop models typically use card-based ticketing (CBT), which stores data directly on a card and limits its use to a specific service provider. While closed-loop models support discounted cards and are popular with senior citizens, students and low-income riders, they can complicate journeys. Users may need more than one card or app if fares are not integrated across providers. Customers must also remember to top up values. Misplacing a card could mean losing all the stored value.

Payment systems based on open-loop technology, on the other hand, bring a cycle of benefits. The massive amounts of data they generate can be used to study passengers’ habits and gain insights, and this can help transit providers optimise and improve services, attract more riders, which in turn helps the environment.

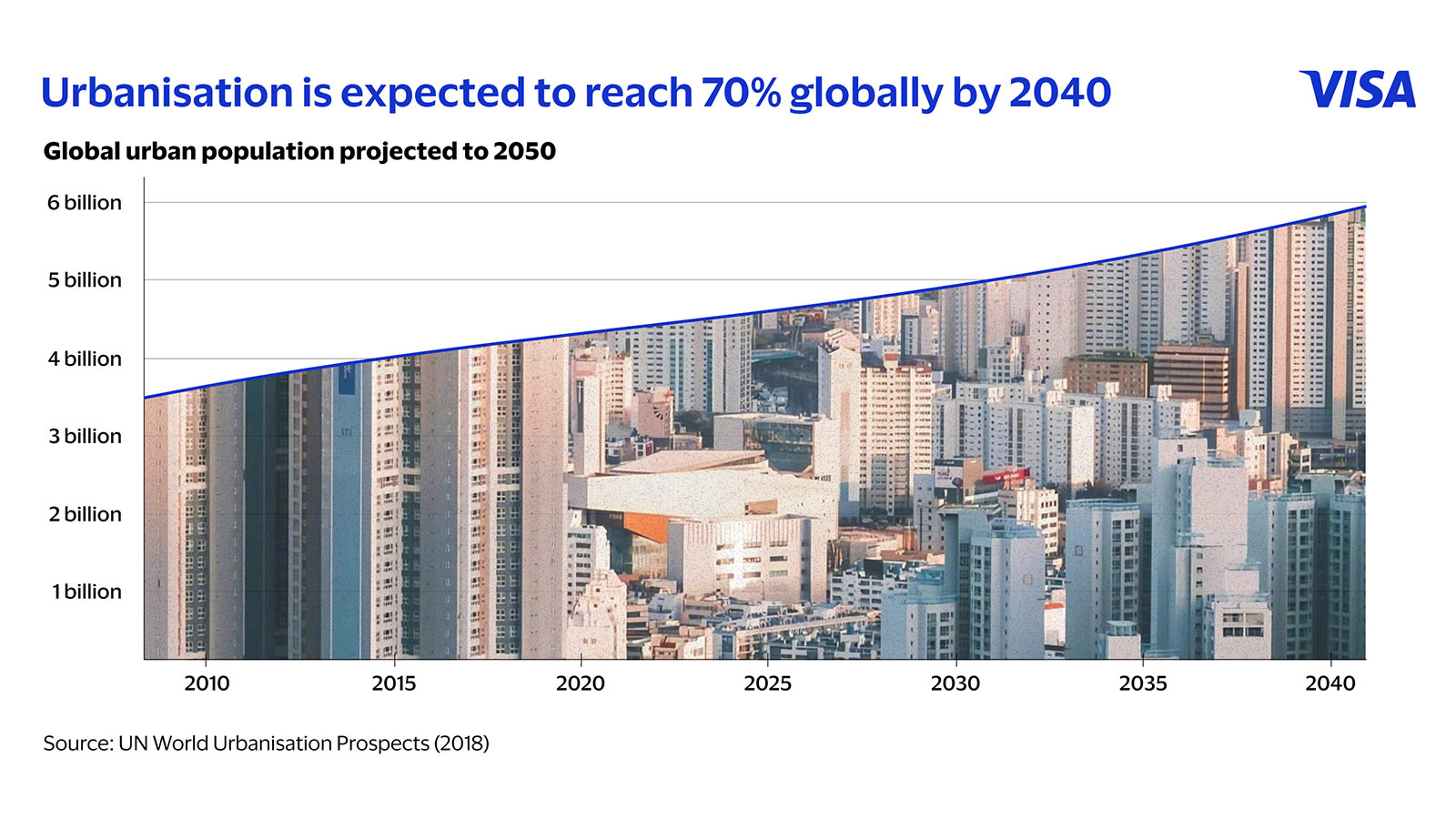

These benefits are critical for Asia’s cities facing chronic road congestion, vehicle pollution and expanding populations. In APAC, some 44 million people flood into the region’s cities each year.¹ Motor vehicle fleets are already doubling every five to seven years and quality public transport services have become essential to avoid an unhealthy shift to private vehicles.

Key to scaling up public transit use

The use of contactless, open-loop payment systems can increase public transit use by an average of 10 percent, according to a global study conducted by Visa Economic Empowerment Institute in partnership with ThoughtLab.²

Indeed, contactless open-loop payment systems are already in use in cities like Hong Kong and Singapore. In Hong Kong, the MTR subway system recently began to accept payments made with Visa cards, joining the major bus companies, the city’s iconic Star Ferry and double-decker tram networks , so that a single Visa card can now be used to tap and ride on all transportation modes. Singapore has SimplyGo, a ticketing platform that accommodates train and bus fare payments with an everyday credit or debit card.

Elsewhere, local transport authorities and city planners are realising the value that open-loop payments can deliver for public transit. In Bangkok and Ho Chi Minh City, for example, Visa has been actively collaborating with authorities to roll out contactless open-loop payments that make commuting easier and more convenient for urban populations. Today, commuters in Bangkok can pay for rides on the Blue and Purple MRT lines with Visa contactless cards, enabled by a partnership between Visa, Bangkok Expressway and Metro (BEM), and the Mass Rapid Transportation Authority (MRTA). In fact, a global Visa study also found that among transit agencies that do not currently have open-loop technology, 83 percent plan to implement it and 70 percent intend to do so within the next two years.

Open-loop transit systems based on ABT architecture can radically change the way people experience public transport and move around their cities. Today, commuters already pay for public transport with a tap of their smartwatches and mobile phones, enabled by ABT and technologies like payment tokens that allow payment credentials to be stored and accessed securely through personal devices.

With biometrics and artificial intelligence (AI) making big strides in recent years, it is not hard to imagine paying for a train ride with a wave of the hand, a glance into a camera, or walking through "hands-free" gates that seamlessly recognise payment credentials that commuters can integrate into clothes or accessories. Cities will be even more open and accessible than ever, especially for the less abled, elderly, or people with children, who can connect more deeply with communities at home and discover more on their travels.

Open-loop payment technology is fast shaping the future of urban mobility in Asia Pacific. As seamless public transport becomes top-of-mind for commuters, it is crucial for policymakers, transport operators, and the payment ecosystem to see the value of open-loop payments in creating more efficient public transit systems. When public transit becomes more efficient, it can also reduce the use on private transportation, aiding a shift to sustainable urban mobility in Asia Pacific and around the world.