Moving money between bank accounts in Southeast Asia used to be slow, inefficient, and expensive. Transfers would take days to clear, leaving recipients and senders alike wondering when funds would be moved.

Real-Time Payments (RTPs) have transformed this. Today, money can move between bank accounts almost instantly by scanning a QR code, entering a unique business or consumer ID, or by entering a phone number via supporting banking applications or digital wallets.

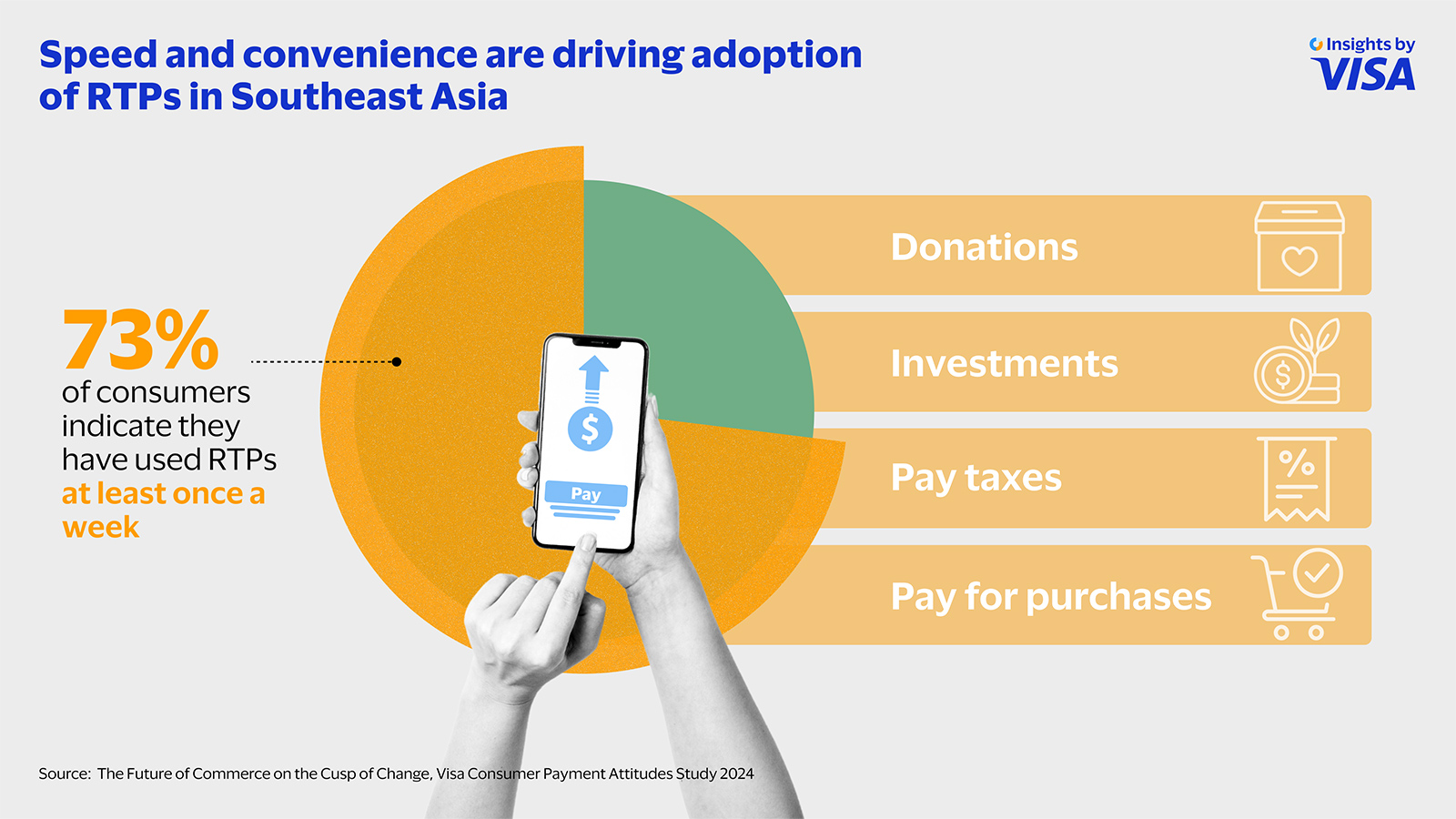

This speed and convenience have fuelled a sharp growth in adoption, with 73% of over 6,550 consumers surveyed in Southeast Asia stating that they have used RTPs to pay for regular purchases, making donations and investments, or paying taxes, according to Visa’s latest Consumer Payment Attitudes Study¹.

An expanding ecosystem

Enabling this embrace of RTPs in Southeast Asia is the growth of supporting ecosystems: ubiquitous data connectivity, proliferation of digital national identification systems, and closer partnerships between banks, banking associations, regulators, and governments.

For example, Malaysia’s DuitNow was formed by the PayNet bank network comprising 11 financial institutions and the country’s central bank, Bank Negara Malaysia², while Singapore’s PayNow was developed by the Association of Banks in Singapore. Central banks also play a key role in enabling cross-border RTP linkages, such as the connection between Singapore’s PayNow and Thailand’s PromptPay in 2021³, and PayNow and DuitNow last year⁴.

As consumer linkages grow, so too do commercial and public sector use cases for RTPs. In Singapore and Malaysia, consumers can scan the same QR codes to make retail payments from either country, potentially boosting retail and commerce for both countries⁵. In Singapore and Thailand, RTPs are also being used to distribute social welfare benefits and financial assistance from the government⁶.

In addition, RTPs, which are accessible via mobile phones, can be used as a tool to promote financial inclusion, particularly in providing access to financial services for Southeast Asia’s large unbanked population (more than 70% of the adult population in the region are unbanked or underbanked⁷) and in integrating small businesses into the digital economy.

Addressing security and operational challenges

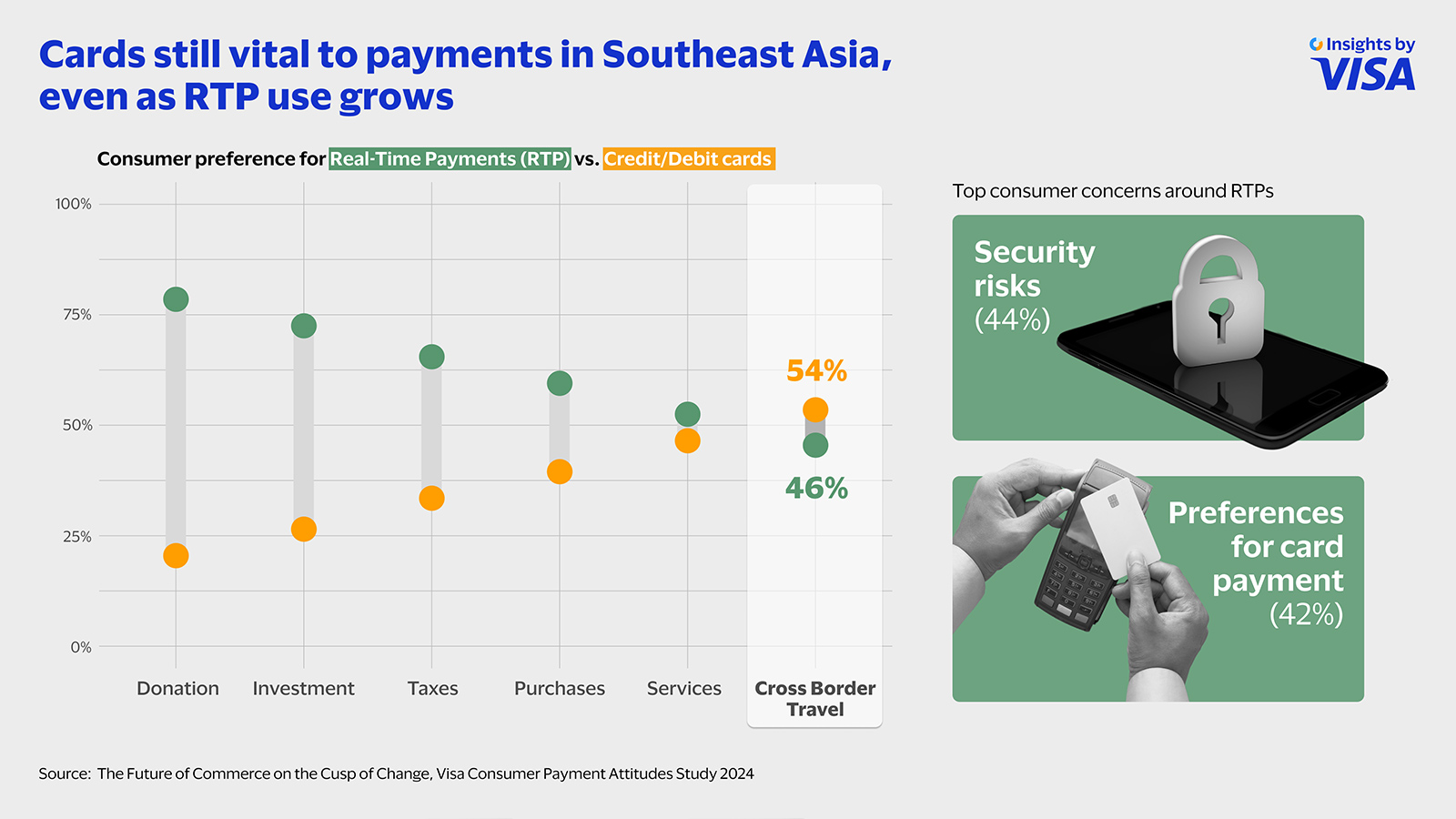

While adoption and utility of RTPs expand, respondents in the Consumer Payment Attitudes Study identified potential security risks (44%) as a limitation, while others cited their personal preferences for payment methods like cards as an obstacle to greater use (42%).

As RTP payments continue to scale, the risk of fraud-related losses can grow because of the innate irrevocability of transactions – as payment settlements are completed at the point of transfer. The instantaneous nature of RTPs, critical to their consumer appeal, can be exploited by increasingly sophisticated bad actors looking for soft spots in payment transactions.

Addressing this will take a multi-stakeholder effort. Governments like Singapore are already mandating banks to notify customers of all RTP transactions to prevent fraud and abuse. A possible next step can be to harness the security capabilities of banks and payment networks, incorporating security solutions such as Visa Protect for Account-to-Account Payments, which uses deep learning artificial intelligence (AI) to detect potential fraud across an RTP network. Easily incorporated into current financial systems, a pilot conducted in the United Kingdom found that more than half of fraudulent transactions that passed bank detection systems were detected by the system, potentially saving US$420 million for the economy .

A second challenge is interoperability, which is key to scaling up RTP usage beyond borders. Respondents in the Consumer Payment Attitudes Study use cards (54%) more often than RTPs (46%) for cross-border transactions, likely driven by wider global acceptance, greater familiarity with cards, and built-in security technologies.

Attempts to establish a wider RTP payments network through a standardised and multilateral approach are underway. One example is Project Nexus, developed by the Bank for International Settlements Innovation Hub in Singapore, which seeks to connect instant payment systems across countries to enable cross-border payments within 60 seconds.

However, silos still exist and the relative lack of standards and protocols for data exchange across RTP networks add to the challenge. This is where financial institutions can help. Cross-border services, for example, can be enabled by Visa Direct, which provides RTP networks access to a global network of more than 190 countries. Leveraging Visa proprietary models, card data, local RTP network data, and learnings from fraud trends across the globe will also improve fraud detection through Visa’s range of security solutions.

The future for RTP is promising. With the number of RTP transactions in Asia Pacific projected to grow to 327.8 billion by 2027 from 49.2 billion in 2022, fostering effective, innovative, and resilient public-private partnerships are critical to its future growth and that of digital payments in Southeast Asia.

¹ Visa Consumer Payment Attitudes Study 2024, accessed Jul 2024

² https://paynet.my/about-paynet.html

⁸ https://www.bot.or.th/en/financial-innovation/digital-finance/digital-payment/promptpay.html

⁸ Visa’s new AI tool could save the UK over £330m a year on fraud and APP scams | Visa Navigate