The Formula 1TM Singapore Grand Prix is the crown jewel in Asia’s motor racing calendar, going toe to toe with circuits in some of the region’s biggest cities multiple times the size of the island nation. It attracts travel from around the world and in doing so, becomes more than a global spectacle by delivering a tourism and economic boost for the city.

This year, VisaNet data continues to uncover just how much of a lift Formula 1TM creates for businesses in the city – particularly the growing role of the nighttime economy in driving tourism spending, along with the prominence of affluent travellers in the spending picture. These insights reveal the value of Visa data that put businesses in the driver’s seat when it comes to unlocking new opportunities in racing-inspired travel.

A landmark moment for travel and “bleisure”

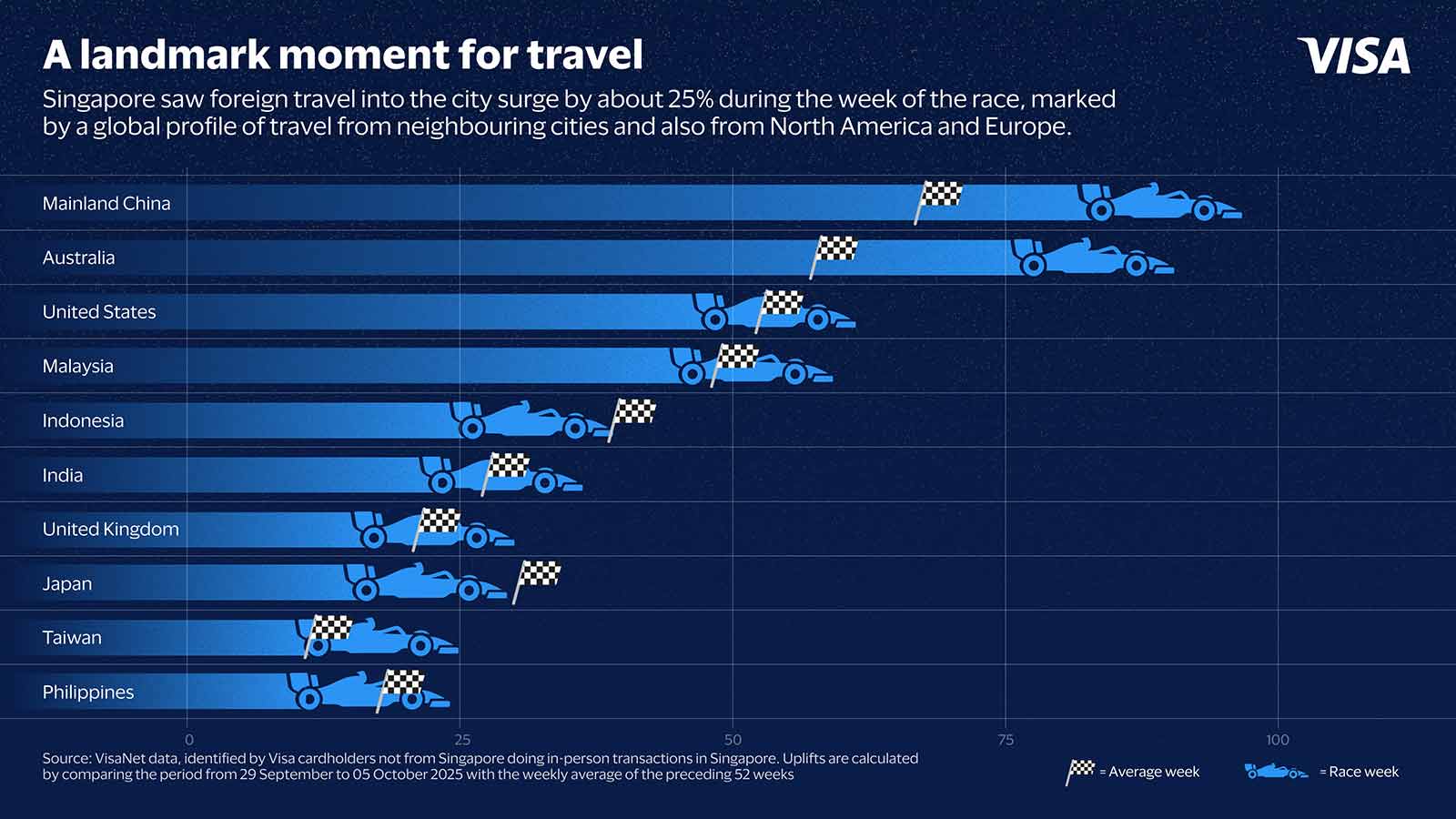

In the week of the race, Singapore again saw an influx of foreign travellersi into the city, with travel into the city growing by around 25% from a typical weekii. What stood out was the global profile of travel: tourists from neighbouring Malaysia were high on the list but ranked fourth by total travel, behind China, Australia, and the United States. Meanwhile, travellers from India, Indonesia, and the United Kingdom also ranked highly.

The spike in tourism created an outsized impact on traveller spending, with tourist receipts growing by approximately 45% during the week of the race. Travel spending from Mainland China, Australia, the United States, and Indonesia accounted for over 40% of spending done by all travellers during the week of the race, showing how Singapore is a major attraction for tourists not only in Asia, but around the world.

Traveller spending is also benefiting small and medium businessesiii (SMBs), who represent the bulk of Singapore’s economy. In the week of the race, SMBs in the city saw traveller spending rise by about 65%, especially in retail and diningiv as racegoers explored the city including its heartlands. Restaurants (~80% uplift) like local eateries and cafes, as well as SMBs in retail such as Electronics (~80% uplift) and Groceries (~120% uplift) saw some of the most notable lifts in traveller spending.

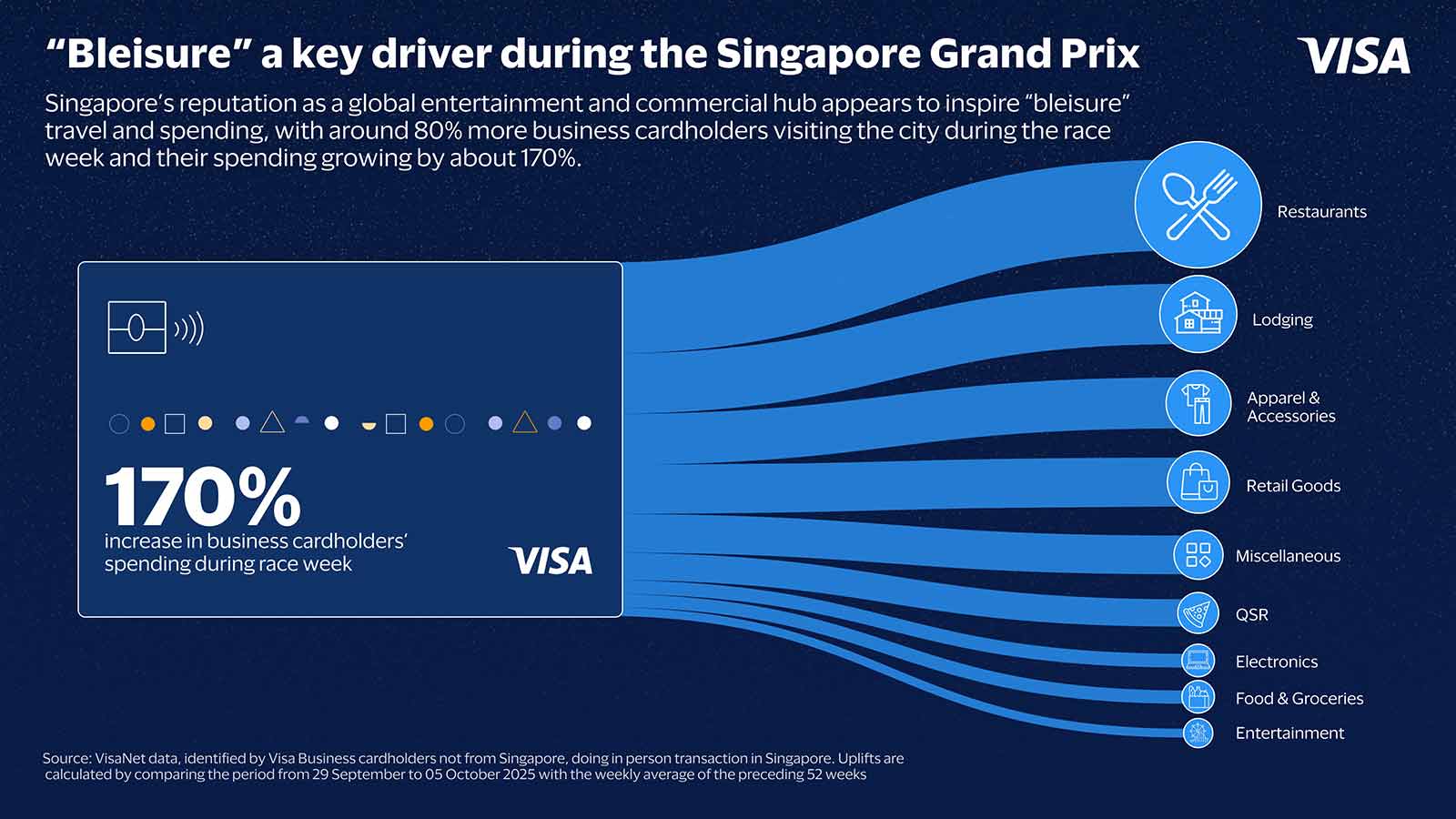

Another key finding was the growth in travel by corporate travellers¹ in the race week, which coincided with various conferences and exhibitions. Compared to an average week, around 80% more business cardholders visited Singapore during the race week with their spending nearly tripling by surging approximately 170%.

This perhaps reflects Singapore’s reputation as a global entertainment and commercial hub, inspiring the rise of “bleisure” travel as corporate travellers make full use of their time on the island to enjoy its wide range of fun and leisure offerings. Visa’s data support this trend, with discretionary spend on Restaurants (~260% uplift) and retail like Electronics (~320% uplift), Apparel & Accessories (~200% uplift), and Department Stores (~180% uplift) seeing a marked increase in spending by business cardholders.

More than 90% of traveller spending was made via contactless card payments, with its volume growing by about 40% from an average week. In addition, contactless transactions are increasingly done with mobile phones and wallets that offer consumers easy access to all their cards at the tap of a button wherever they travel, with mobile-based contactlessi transactions surging by about 80% as travellers again find more seamless and secure ways to pay on their travels.

What it means: Issuers and merchants alike must cast their nets wider to capitalise on the global appeal and opportunity of the Singapore Grand Prix. Issuers worldwide should start early by identifying when cardholders are planning a trip to Singapore for the annual race to capture revenues from hotel and flight bookings. When the race week rolls around, targeted partnerships or promotions with local businesses can ensure that they too capture a share of the spike in travel spending.

For merchants, especially SMBs, the opportunity is clear. They must put themselves front and centre to a global customer base of avid racing fans – be it expanding dining menus to help travellers sample Singaporean cuisine or by positioning smartly along where travellers are going when the race rolls into town.

Above all, with digital and contactless payments essential to the way the world travels, digital acceptance will make it easy for merchants to unlock the tourism boost generated by the race.

Nighttime economy a hidden growth engine

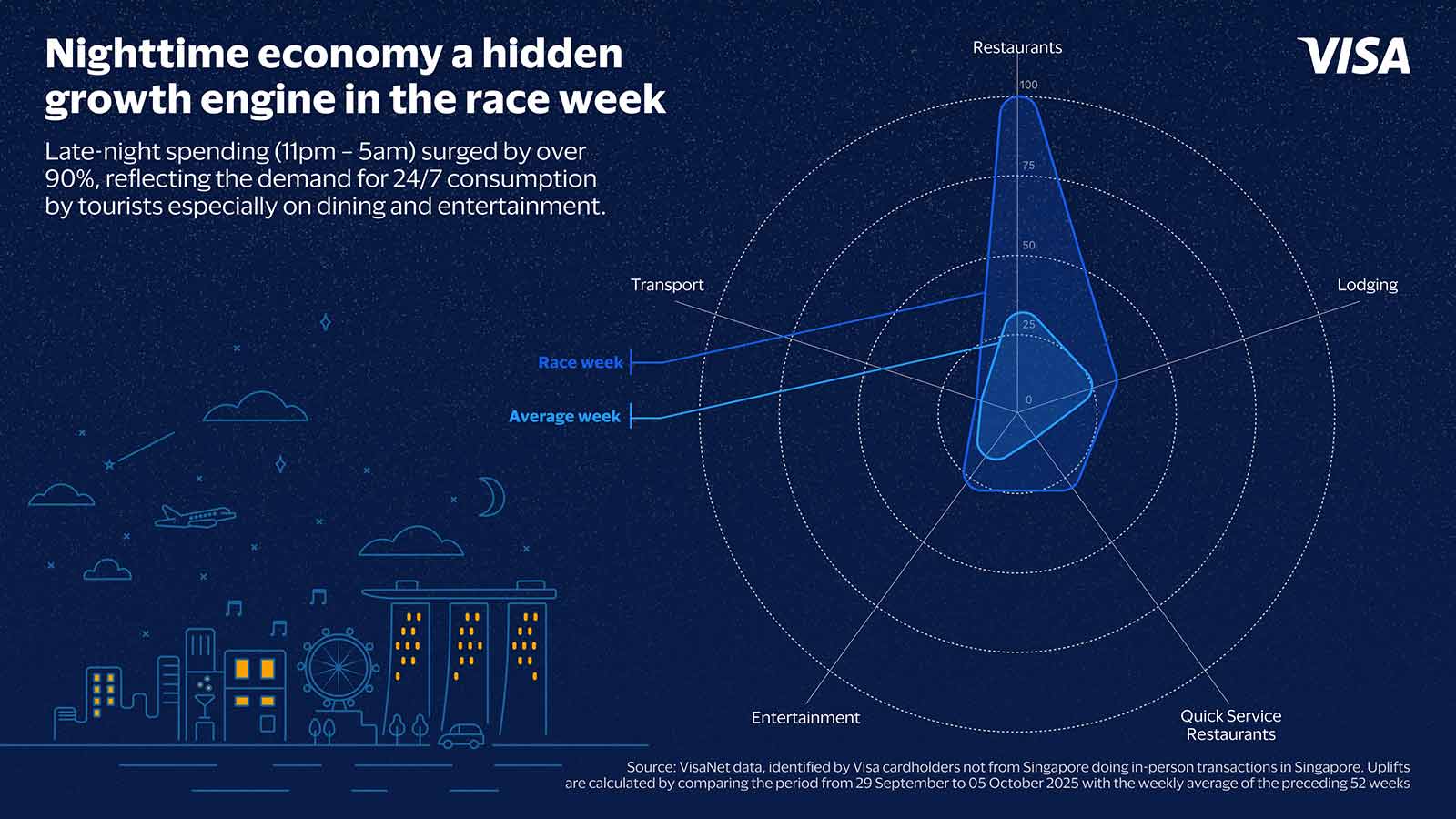

An often-overlooked part of travel spending patterns in major sport and cultural events is when travellers are spending. With the events such as the Singapore Grand Prix and music concerts typically held in the evenings, they tend to generate a nighttime spending boost as travellers turn to dining and retail options offered directly at the event, while also visiting bars and other entertainment options after the events are over.

In the week of the Singapore Grand Prix, late-night spending (11pm – 5am) surged by over 90%, reflecting the demand for 24/7 consumption by tourists. Visa found that travellers are looking for food and fun after dark, with Restaurants, Fast Food, and Entertainment seeing the most traveller spending – no doubt partially fuelled by racegoers hungry for a meal or eager to discuss the day’s races with friends. Wide availability of these options in the Marina Bay region hosting the circuit, and in areas like Clarke Quay and Tanjong Pagar just a short walk away likely contributed to the surge in spending.

What it means: Beyond the obvious opportunity for merchants to extend operating hours during major sporting and cultural events, they can also repurpose their premises or offer thematic promotions to attract racegoers after the checkered flag.

For instance, the many cafes and eateries dotting Singapore’s city centre can offer group dining menus or provide entertainment in the form of live music and bands for fans to unwind after the race. Issuers can also tap on the demand for entertainment by sharing nightlife guides for cardholders to explore hidden nooks across Singapore, potentially in partnership with travel authorities like the Singapore Tourism Board.

Affluent travellers: small number, big impact

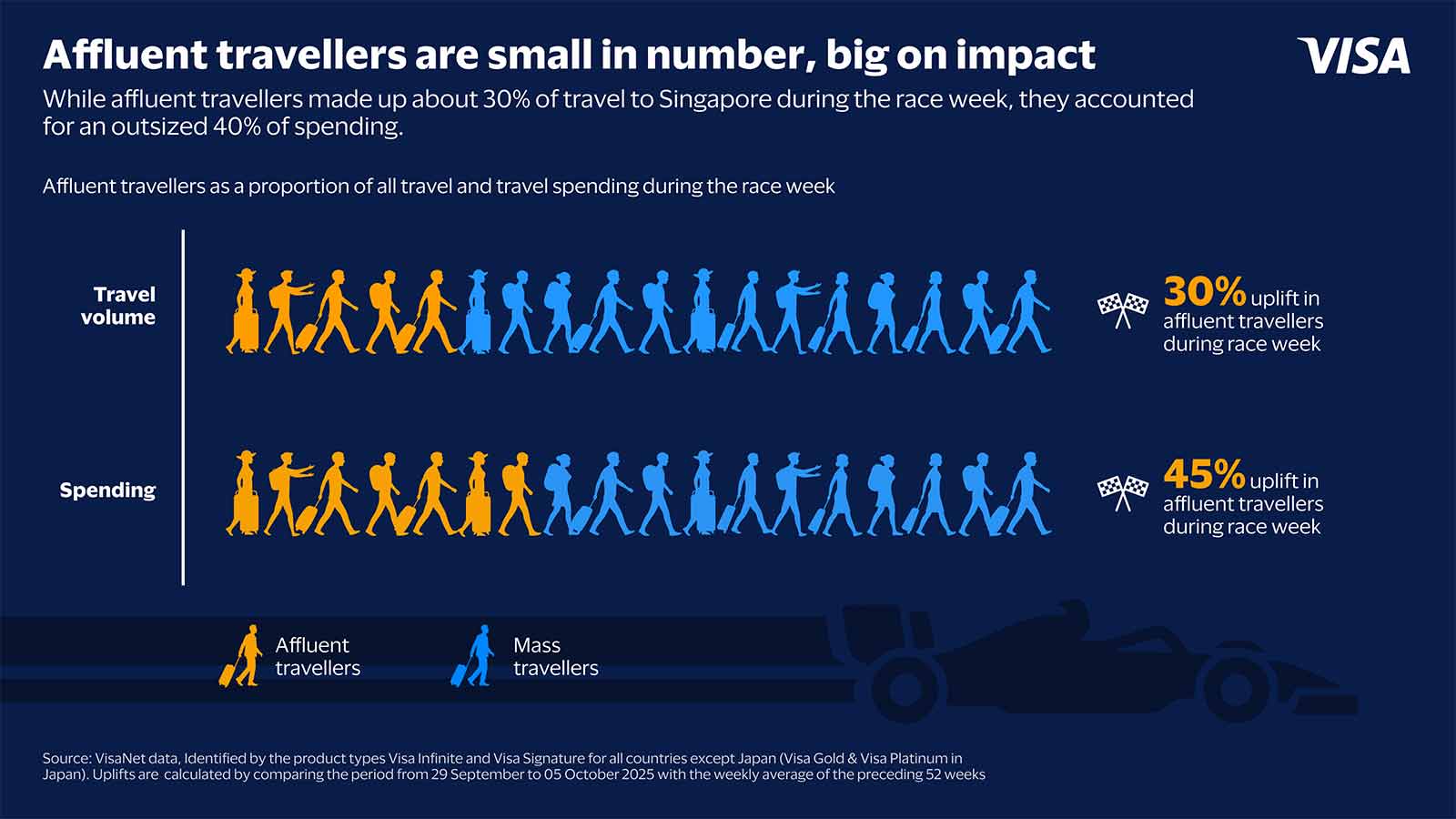

Finally, Visa data found that while affluenti travellers made up about 30% of all travellers to Singapore during the race week, they accounted for an outsized 40% of spending – a sign of their prominence in driving the Formula 1TM fever. Compared to an average week, affluent travel into Singapore was about 30% higher but their spending surged by nearly 45%, reflecting the sophisticated allure of the Singapore Grand Prix, matched by the cosmopolitan appeal of the city preferred by more sophisticated travellers.

Affluent travellers are also highly diverse spenders. While the bulk of affluent spending was on retail and dining, such as for apparel (~15%) and at restaurants (~15%), it seems that affluent travellers were also keen to sample a wide range of local retailers and services, from Discount Stores (~450% uplift) to Electronics (~100% uplift).

What it means: Affluent travellers are now a strategic consumer segment that issuers and merchants must address to capture the lion’s share of tourism brought about by major events in Asia Pacific. It is not simply about curating premium offerings – while those continue to be appealing to affluent travellers, a marked growth in spending on discount stores and related categories means businesses across all segments should start to better understand the evolving preferences of affluent travellers to capture a larger slice of their spending.

For instance, issuers can curate more holistic shopping recommendations for affluent travellers across their journeys to drive card use and cardholder loyalty. For merchants, incorporating premium elements in their storefronts and menus, especially in peak event periods, can help drive store traffic and help them win new customers.

Visa Consulting and Analytics (VCA) harnesses Visa’s payments expertise and proprietary analytics to deliver insights that drive better business outcomes and improve customer journeys. Our team of consultants, data scientists, and experts harness the global reach of the Visa network and cutting-edge technology including Agentic AI capabilities to help clients formulate strategies that capture the biggest payment opportunities, optimise portfolios, and execute digitally more effectively.

Learn how you can work with VCA here.

Disclaimer: Visa has no commercial affiliation or sponsorship relationship with Formula 1TM. All insights and data provided are based on VisaNet data from 29 September to 5 October 2025 during the week of the Singapore Grand Prix.

___________________________________________

¹ Identified by Visa Business cardholders not from Singapore, doing in person transaction in Singapore

i Identified by Visa cardholders not from Singapore doing in-person transactions in Singapore.

ii Calculated by comparing the period from 29 September to 05 October 2025 with the weekly average of the preceding 52 weeks

iii Identified by merchants with annual merchant sales value less than USD$1 million

iv Identified by transaction’s merchant code category

v Identified by mobile contactless transactions from VisaNet data

vi Identified by the product types Visa Infinite and Visa Signature for all countries except Japan (Visa Gold & Visa Platinum in Japan)